5 Best Wine Investment Platforms

Wine industry professionals know that certain wine bottles from highly sought-after vintages can fetch thousands of dollars at auction, while their value keeps increasing every year making wine investment particularly interesting.

These sought-after bottles become more rare and valuable as time passes.

Although not everyone can afford these famous labels, and everyone doesn’t have the same risk appetite, there is a variety of investment platforms available that make wine collecting more affordable for all income levels. In the alternative investments sector, fine wine makes a great investment for those who wish to diversify their investment portfolio.

How to choose the right wine investment platform

The majority of wine produced and sold each year is consumed with intent. However, there are a few wines that are purchased for investment purposes. These wines will appreciate in value over time and are classified as investment grade wine.

Ease of Use

It is essential to have a solid understanding of how to navigate any platform or investment tool. Customers who aren’t sure where to look for answers or make changes will not be able to invest successfully.

Many of the online wine investment platforms are now online-based. This means that the website is an essential part of their infrastructure. It is not recommended to have complicated or confusing websites as they risk that customers will leave these platforms.

High-end websites are easy to use and responsive. This is why most of the best online wine investment platforms today offer high-end services. Customers can navigate easily through the features and take full control over their investments.

Many of the top wine investment platforms have full-time customer service representatives who are available via phone during business hours. Some also offer online chat capabilities that allow you to outsource your issues to third-party representatives.

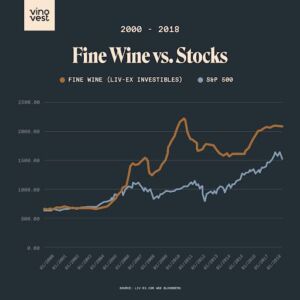

Vinovest, one of the most well-known platforms for investing in wine, also features line graphs and charts similar to those used in stock market movements and other traditional asset classes. This allows you to easily keep track of your investments and monitor your money’s progress over time.

Return on Investment

The whole point of investing is to get a return on your investment and feel the benefit of compound interest. You should choose a wine investing platform that has a proven track record of consistently producing returns for customers to make sure you maintain a balanced portfolio of assets.

Stock market fluctuations are common, but changes in wine portfolio value are often more dependent on internal factors than external factors. It is important to choose the right platform and the right strategy.

There are certain labels of wine that are well known within the industry to be “as good as gold,” as they will nearly always continue to increase in value over time given that the wine is properly preserved in a dark temperature-controlled area.

These collectible bottles are multi-thousand dollars bottles such as the first Bordeaux growths that can fetch prices exceeding $10,000 at an auction, depending on the vintage. These are the bottles that inspired certain wine investment platforms.

Wine investment platforms can combine the resources of many investors to buy high-end wine bottles that will almost guarantee the investor a return on their investment over time.

Some wine investment services place more emphasis on new labels that have high upside than on established wines that are well-known and expensive. These services may offer higher returns but are more risky assets to invest in. Bare in mind that no matter the return, consult a financial advisor because capital gains tax is something you will have to be mindful of when you decide to sell.

Business Model

Wine investment platforms can use a variety of business models to make a consistent profit. Each company is different in terms investment style but they all have their own business structure.

Vint is a company that only serves citizens of the United States. They have been fully qualified by American Securities and Exchange Commission. While this provides peace of mind for many, it makes the service unavailable to international customers.

Vint allows investors to start with deposits as low as $100. However, some companies require higher minimums for certain services. Cult Wine Investment requires customers to deposit a greater minimum, with $10,000 the entry-level investment.

Alti Wine Exchange, which uses blockchain technology for each wine bottle to be assigned a non-fungible token, is one example of another company that employs high-tech ways of protecting customers’ investments.

Vinovest is a leader in the industry and uses high-tech methods to bring back their clients. They use artificial intelligence technology in order to monitor market trends and find the best investment opportunities to suit their customers’ needs.

Wine Portfolio

There are many ways to structure a wine investing platform. However, one thing unites them all: they purchase bottles of wine with the intent of reselling them later for a profit.

The best way to invest your profits in wine is to select the most well-known wines in the world. This will ensure that you make a profit. This sector was difficult to enter because it was one of the first forms of wine investment.

Most of the top wine bottles in the world in terms of quality, fame, investment potential, and investment potential are already gone. They are currently in the portfolios some of the most renowned and established wine collectors around the globe.

Few bottles of first-growth Bordeaux that are available at auction have a high price tag because many investors are competing for the same bottle every year.

This makes investing in fine wine portfolio more like investing in art than traditional investments such as stocks and bonds. A well-curated wine portfolio requires both an eye for detail and knowledge of the industry.

Different companies use different methods to determine which wines will yield the highest returns over time. Some companies rely on industry professionals’ knowledge, while others rely on algorithms and high-tech methods.

Reputation and Customer Service

You should also consider the reputation and reliability of each platform for wine investment. Although it is impossible for companies to guarantee returns or results, they can provide excellent customer service and ethical business practices.

Communication with customers is a key factor in establishing a reputation in the fine wines sector. For all customer questions, the best companies will have customer service representatives available during business hours.

Before doing business with an investment company, it is important to check its reputation on the website. For quality business practices, reputable companies will have at least an A rating.

You can also search for reviews online to get a better idea of the company’s operations. However, reviews are less reliable than reviews when it comes to research and assessing a company’s reputation. Reviews are an indicator of quality in certain industries but not so much for investments.

Investors have unrealistic expectations about investing money in investment products. Others believe they can guarantee results. Customers who are unhappy with their investments leave negative reviews to try to harm companies.

Avoiding wine investment platforms that use less-than-reputable business practices is the best way to avoid them. Stick with established companies with a high rating with The Better Business Bureau. Referrals by word-of-mouth are great, especially if the person giving them is trustworthy.

Top 5 Wine Investment Platforms

It can be difficult to choose the right wine investment platform with so many options available. It is important you do your due diligence before you start investing and buying in wine stocks.

We’ve highlighted five of today’s best investment options and listed the key features and drawbacks for each.

1. Vinovest

Pros

There are four investment options starting at $10,000

A custom-built wine portfolio can be built in two to three weeks.

Combining sommelier information with data and artificial intelligence

A simple interface that is easy to use and understands

One-on-one consultations with personal portfolio advisors are available

We are partnered with master sommeliers who can help you identify and procure wine

Cons

Some wine lovers find a minimum investment of $10,000 too steep.

Selling wines from the portfolio in the first three year is punishable by a fine

Below $50,000, there is minimal portfolio customization.

Vinovest is a well-known name in online wine investment. They have built a solid reputation among their customers since the introduction of an artificial intelligence wine investment platform in 2109.

2. Cult Wine Investment

Pros

Apps and websites of high quality allow investors to track their investments easily.

Climate controlled warehouses are very secure and fully insured against damage

The educational materials included in the package help users become smarter investors

One of the most important wine investment platforms in the world

You can get personalized portfolio advice at any time

Excellent track record in providing responsive and high-quality customer service

Cons

Another service that requires a minimum investment of $10,000

Lower investment levels only get limited customization resources

New customers do not qualify for any introductory offers

Cult Wine Investment is a leading platform for online wine investing. Cult Wines allows users to sell and buy wine bottles from around the globe. The bottles are stored in a climate-controlled, safe location.

3. Vint

Pros

This is one of the easiest platforms to find new wine investors

Only $25 minimum investment

You can buy fractional shares in many different wines and collections.

Portfolios that include both quality wines and aged spirits are diverse

The United States Securities and Exchange Commission regulates

One of the few companies that does not charge an annual management fees

Cons

There are only a few investments available at any one time

There is less flexibility and customization available than other services.

Users cannot cash out their investments too early.

Vint is an online platform for wine trading that offers a different approach to wine investment management than other companies. There are no management fees or access tiers, and entry costs are lower than other services.

4. Alti Wine Exchange

Pros

Blockchain technology allows for secure and completely safe trading

To procure wine, a special process is used called the initial bottle offering

Users have access to a secondary market that allows them to liquidate their portfolios at anytime.

A live bidding platform for stock exchanges that is easy to use

Wines are stored in high-quality wine storage facilities.

Cons

Certain “old-school” investors are not fond of blockchain technology.

Margin trading and short-selling are not possible

Every transaction is subject to a 2 percent trading fee

Alti Wine Exchange is a leader in the wine investing industry. They were established with the intent of connecting users to tools and genuine wines, while avoiding fake bottles and other wine frauds.

5. Vindome

Pros

You can buy wine from the live market, or browse our whole wine collection here.

There are two ways to sell wine: either match an existing bid or make a sale offer.

Every wine is microchipped before being stored in a secure warehouse

It’s easy to track your investments using the app.

To help customers become smarter investors, the website also includes a wine guide.

Cons

Each transaction incurs a high fee of up to 4 percent

It is not one of the most well-known or largest names in the wine investing industry.

Blockchain technology-based platforms are not popular with wine lovers.

Vindome, is well-known for its tried and true business model in the fine wine market and slight innovations that many customers love.

There are two ways you can buy wine, as well two ways you can make wine merchant sell it. They use unique microchip technology for tracking their wines.

The Best Wine Investment Platforms – Final Thoughts

There are many good investment options available for investment wine trading platforms. However, Vinovest is the best choice for most customers.

Although the minimum investment of $10,000 may seem high to some investors, Vinovest has the best combination of quality features and an easy-to-navigate website. It also has a reputation of reliability in investment wine as an alternative investment.

To take a look on Vinovest’s website and determine if their investment wines are right for you, click here.

- Tags:

- investing