Famous Investors: Profiling the Market’s Financial Visionaries

The investment landscape is dotted with individuals whose expertise in navigating the volatile terrains of stocks, bonds, and various asset classes has distinguished them as titans of the financial world. These renowned figures have managed to consistently outperform the general market, bringing significant wealth to those who have invested alongside them. Their adeptness in identifying undervalued securities, formulating robust investment strategies, and maintaining strong portfolios has not only earned them substantial net worths but has also secured them a place in the pantheon of investment legends.

These trailblazers have made names for themselves through a variety of techniques; from value investing to aggressive hedge fund management, each has honed a unique philosophy that informs their approach to the market and their management of assets under management. They’ve mastered the art of risk and return, and their successes offer insights into the power of financial acumen and market theory. Their stories resonate with both seasoned and novice investors, providing a blueprint for building wealth through investments that have the potential to yield earnings far above the average annual return.

Key Takeaways

- Renowned investors have significantly outperformed the market, crafting successful long-term strategies.

- Diverse investment philosophies and techniques characterise their approaches to wealth creation.

- Their mastery over portfolio management and market prediction has made them icons of the financial industry.

1. Bill Ackman

- Institution: Pershing Square Capital Management

- Investment Style: Activist shareholder

- Performance (2003-2021): 17.1% average yearly return

- Comparison: Surpasses S&P 500’s 10.2% average yearly return

- 2022 Q1 Performance: Fell by 1.7% but still ahead of the S&P 500 by roughly 3%

Bill Ackman is at the helm of the investment firm Pershing Square Capital Management, known for its strategic approach to increase shareholder value. Over a span of nearly two decades, his management has delivered returns that consistently beat the leading market indexes. Despite market downturns in 2022, his firm managed to limit losses and remain ahead of the S&P 500 index. Ackman’s notable success can be attributed to his activist investment strategy, wherein he acquires significant positions in undervalued public companies. He advocates for changes within these organisations to unlock and enhance their value, divesting only when his financial objectives are met.

2. Benjamin Graham

Benjamin Graham, recognised as the “father of value investing,” established a strategy in the 1920s focusing on identifying and purchasing stocks for less than their real worth. His seminal works, “Security Analysis” co-authored with David Dodd, and “The Intelligent Investor”, have shaped the principles of investment analysis.

- Columbia University: Graham lectured here, influencing many, including Warren Buffett.

- Great Depression: His strategies were developed during this period’s economic challenges.

- Margin of Safety: A key concept in Graham’s investment philosophy to ensure reduced risk.

Graham’s legacy continues to guide investors seeking long-term value.

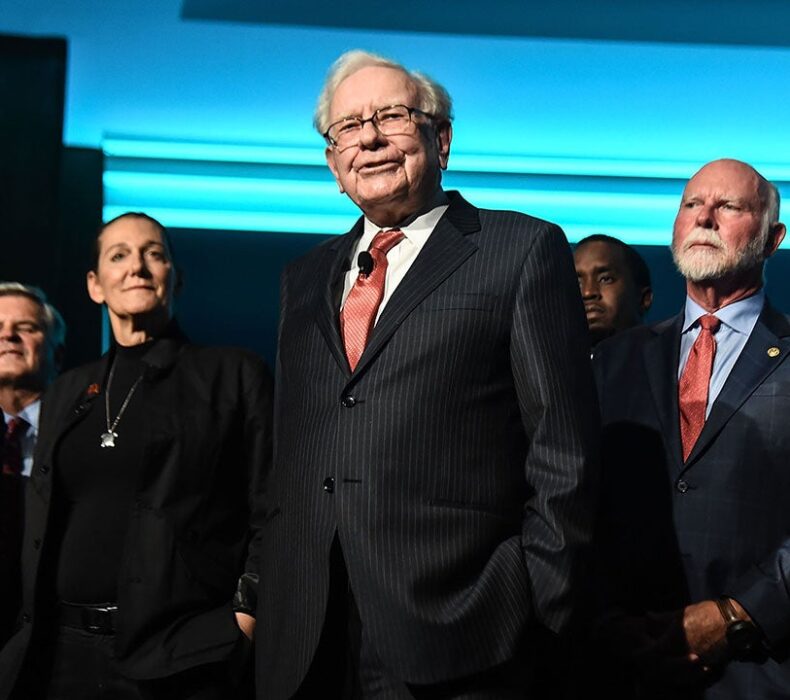

3. Warren Buffett

- Nickname: Often referred to as the Oracle of Omaha

- Early Career: Mentored by Benjamin Graham, embraced value investing principles

- Berkshire Hathaway:

- Acquired in 1965, transformed from a textile company to a diversified holding titan

- Ticker symbols: BRK.A and BRK.B

- Houses a vast portfolio spanning numerous industries

- Recognised for its ownership of widely known global brands

- Investment Philosophy: Prioritises purchasing shares in reputable firms at reasonable valuations

- Performance:

- Delivered a remarkable compound annual growth rate of 20% since 1965

- Outstrips the S&P 500’s returns by a substantial margin

- Location: Founded and based in Omaha, Nebraska

- Business Partner: Worked closely with Charlie Munger, contributing to investment strategies and decisions

Warren Buffett has consistently demonstrated shrewd investment expertise, substantially elevating the fortunes of Berkshire Hathaway and establishing it as a major player in sectors such as insurance, energy, and industry, and is prized for its substantial influence within the financial markets. Warren Buffet is a great believer in Index funds and is an advocate of everyday individuals investing their money into an index fund and tax efficient wrapper to grow their wealth.

4. John (Jack) Bogle

John (Jack) Bogle revolutionised the investment world when he established The Vanguard Group in 1975. His innovation in developing no-load mutual funds allowed investors to bypass costly sales charges that were typically incurred from third-party brokers. Bogle’s introduction of the Vanguard 500 sought to emuluate the S&P 500’s outcomes at a fractional cost. The method of index investing he championed offers a way for investors to attain market-equivalent returns without incurring hefty fees. This concept has gained immense traction, particularly with the advent of exchange-traded funds (ETFs).

5. Cathie Wood

Cathie Wood stands at the helm of ARK Invest, a company that she established in 2014 and has been guiding as the CEO and chief investment officer. ARK Invest specialises in exchange-traded funds (ETFs) and has seen its assets under management burgeon to $24 billion by the dawn of 2022. One of their prime ETFs, the ARK Innovation ETF, delivered a return of 177% over a span of five years up to the early months of 2022.

Key Points:

- Despite a downturn in technological stocks affecting the fund’s peak performance, it still outperformed the S&P 500, which registered a 106% return within the same timeframe.

- Wood interprets the downturn as an advantage, signalling a time to buy for those looking forward to long-term investment horizons.

- The investment strategy at ARK is ambitious, aiming for a 15% annual growth over five years, yet Wood anticipates the possibility of achieving returns exceeding 50% as markets rally.

6. Peter Lynch

- Managed Funds: Peter Lynch led the Fidelity Magellan Fund from 1977-1990.

- Asset Growth: Grew the fund’s assets from $20 million to over $14 billion.

- Performance: The fund exceeded the S&P 500 performance 11 out of 13 years.

- Annual Returns: On average, annual returns were 29%.

Publications by Lynch:

- Investment Guides: Authored ‘One Up on Wall Street’, followed by ‘Beating the Street’.

- Beginner’s book: Co-wrote ‘Learn to Earn’—an introduction to the market for new investors.

Lynch’s guidance on investment became crucial reading, providing myriad insights for potential investors. His tenure at Magellan is particularly noted for significantly amplifying the fund’s value and consistenly surpassing market averages.

7. Carl Icahn

- Profession: Prominent activist investor

- Strategy: Acquires major stakes in undervalued public firms

- Aim: Increments in shareholder wealth through corporate adjustments

- Reputation: Known in the 1980s as a “corporate raider”

- Approach: Advocates for management and governance reform

- Method: May instigate hostile takeovers to restructure companies

Carl Icahn possesses a firm belief in reforming companies by challenging their operational practices and leadership, leveraging significant ownership to prompt strategic turnarounds or leadership alterations. His investment philosophy revolves around rectifying perceived mismanagement to unlock shareholder value.

8. Chamath Palihapitiya

Before leaving Meta Platforms in 2011, Chamath Palihapitiya was an influential senior executive, and since then, he has made quite an impact in the venture capital landscape through his establishment of Social Capital, formerly known as The Social+Capital Partnership. As an engineer turned financier and CEO at Social Capital, Palihapitiya primarily focuses on supporting tech startups.

Notable Business Exploits:

- Venture Capital:

- Focus: Technological startups

- Initiative: Started Social Capital in 2011, renamed in 2015

- Public Market Ventures:

- Method: Special purpose acquisition company (SPAC) strategy

- Accomplishments: Assisted several ventures in going public

- SPAC Mergers:

- Virgin Galactic: Commercial spaceflight venture

- Opendoor Technologies: Online real estate marketplace

- SoFi: Financial services platform

- Clover Health: Data-oriented health insurance

Despite fluctuating market performance, with an average market value decline of 30% in 2021 for the companies he took public, he retains a reputation as a significant figure in SPAC transactions, earning the moniker of the “SPAC King.” This title recognises his propensity to identify and introduce pioneering firms to the stock market.

9. George Soros

- Founded Soros Funds Management in 1973

- Evolved into the Quantum Fund

- Notable for aggressive, successful strategies

- Often exceeds 30% annual returns

- Achieved gains above 100% in select years

- Specialises in bold, short-term currency and security bets

10. Sallie Krawcheck

Sallie Krawcheck holds the position of CEO and is a co-founding member at Ellevest, a platform designed to empower women through digital investment services. In addition, she presides over the Pax Ellevate Global Women’s Leadership Fund, which invests in firms that excel in promoting female leadership.

Her career trajectory in finance has seen her at the helm of prominent institutions such as Merrill Lynch and Smith Barney, her leadership extending to US Trust, Citi Private Bank, and Sanford C. Bernstein. Her endeavours are committed to assisting women in achieving their economic and career aspirations, aiming to reduce the discrepancy in income and wealth between genders.

In mid-2022, Krawcheck engaged with The Motley Fool for a conversation on their podcast series, providing insights into her financial perspectives and strategies.

11. John Templeton

- Early strategies: Gained wealth by investing in undervalued stocks during the Great Depression.

- Templeton Growth Fund: Established in 1954, managed for 38 years with annualized returns over 15%.

- Investment milestone: Revolutionized the mutual fund sector with his innovative global funds.

- Legacy: Sold Templeton Funds to now known as Franklin Resources, setting a benchmark for future fund managers.

- Pioneering work: Led the frontier of international investing with remarkable success.

12. Achievements of David and Tom Gardner

- Founded The Motley Fool in 1993.

- Aim: Equip individuals with financial knowledge.

- Launched Stock Advisor programme February 2002.

- Return for subscribers: 353% (up to May 9, 2022).

- S&P 500 comparison: 123% in same period.

- Investment approach: Recommend and personally invest in suggested stocks.

Renowned Figures in Investment

While the investment world often celebrates the likes of Warren Buffett and John Templeton for their value and contrarian investment strategies, several other individuals have carved out significant reputations in similar fields. Jim Rogers and Marc Faber stand among these respected figures for their prowess in value investing.

In the realm of growth stock investment, two notable pioneers come to mind:

- Thomas Rowe Price Jr., hailed as a key proponent of growth investing

- Phillip Fisher, whose strategies solidified his legacy in growth investing

The investment landscape, however, extends beyond the stock market. Property investment has elevated individuals such as:

- Sam Zell

- Stephen Ross

- Donald Trump

They each have utilised real estate as a vehicle for substantial financial gain.

In the fixed income space, Bill Gross has established his domain. Known colloquially as the “King of Bonds”, he has demonstrated a preference for the bond market over equities.

Shared Traits of Prominent Investors

Highly successful investors often set themselves apart through certain shared characteristics, evident in their investment strategies and track records. Here are some of the key attributes that underline their success:

- Long-Term Perspective: They exhibit patience and an understanding that true value compounds over time. This mindset helps them to not only weather the storms of market volatility but also to capitalise on investment recovery periods.

- Consistency in Execution: Through thick and thin, these investors consistently apply their chosen strategies. Rather than being swayed by short-term market fluctuations, they maintain their course, which often leads to superior performance over the long haul.

- Disciplined Investment Approach: A disciplined framework ensures they make decisions based on thorough analysis rather than emotions. This rigour underpins their process and helps in avoiding impulsive trading that could harm the portfolio’s performance.

- Focus on Strong Fundamentals: Selecting companies based on robust fundamentals is at the heart of their investment selection. They tend to favour businesses with solid balance sheets, manageable levels of debt, and the potential for sustained growth.

- Specialisation in a Niche: Many have carved out a niche, becoming masters of a particular investment style, be it in identifying undervalued stocks, high-growth prospects, or engaging in activist investing to unlock value.

| Decade | S&P 500 Price Return | Return Excluding 10 Best Days |

|---|---|---|

| 1930s | -42% | -79% |

| … | … | … |

| 2010s | 190% | 95% |

| 2020s | 18% | -33% |

The table illustrates that resilience can significantly affect returns. Those who maintain their investment positions during downturns rather than exiting the market can be better positioned to benefit when the market recovers. Investing, for them, is not just about selection but also about timing and staying invested.