Natwest Rooster Money: Simplified Financial Management for Families

If you’re a parent and you want make you children financially literate, check out Natwest Rooster Money. NatWest have established a brand and financial tool designed to help children and teens develop good money management skills. Available exclusively in the UK, it consists of a kids’ prepaid debit card and a pocket money app that allows parents to monitor their child’s spending, set limits, and get real-time spending notifications. As an added benefit, NatWest customers receive a free Rooster Card subscription, which normally costs £19.99 a year or £1.99 a month.

One of the main features of NatWest Rooster Money is the ability for parents to set up custom saving pots for their children. This helps kids learn about setting financial goals and understanding the value of saving for future purchases. Additionally, the Rooster Card offers security features such as the ability to freeze the card, one-time CVV for online shopping, and built-in blockers to prevent overspending and debt.

Key Takeaways

- NatWest Rooster Money provides a kids’ prepaid debit card and pocket money app for effective financial education

- Parents can monitor spending, set limits, and create custom saving pots for their children

- Security features include a freeze card option, one-time CVV for online shopping, and built-in blockers to prevent debt or overspending.

What is Natwest Rooster Money?

NatWest Rooster Money is a family pocket money app and card designed for kids on their journey to money confidence. The system begins with a Star Chart, progresses to a Virtual Money Tracker, and ultimately leads to the child’s own prepaid debit Rooster Card. This innovative tool focuses on providing family-friendly controls and oversight for kids good money habits.

The Rooster Card subscription offer is free for NatWest customers, while non-customers can access it for a fee. The Rooster Money app allows parents and guardians to set spending limits, add funds to the card, and receive real-time spend notifications. Security features such as a freeze card option, one-time CVV for online shopping, and built-in blockers provide peace of mind and ensure safe spending for youngsters.

In addition to the prepaid debit card, the Rooster Money app offers a comprehensive solution for teaching children about money and financial responsibility. With its range of features and user-friendly interface, the app aims to build children’s money confidence from an early age, setting them up for a successful financial future.

By incorporating the Rooster Money app and card in their daily routines, families can foster a sense of financial awareness and responsibility in their children. Through hands-on experience and practical guidance, kids learn valuable life lessons about saving, spending, and managing money, all within a secure and controlled environment supported by the trusted NatWest banking name.

Main Features of Natwest Rooster Money

Natwest Rooster Money aims to provide parents and children with a simple and effective way to manage pocket money and teach financial responsibility. The platform offers a variety of features to enhance the user experience.

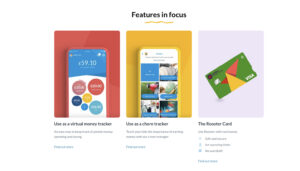

One notable feature of Natwest Rooster Money is the Rooster Card, a prepaid debit card designed for children aged 6-17 years old. This card allows children to learn about spending and saving while giving parents complete control over their child’s spending.

In addition to the Rooster Card, the platform offers a Virtual Pocket Money Tracker. With this tracker, parents can set allowances, track spending, and give tips to encourage savings. It further enables children to set their savings goals and visualise their progress towards achieving them.

The Star Chart is another beneficial feature of Natwest Rooster Money. This interactive chart encourages children to earn stars by completing tasks, chores, or exhibiting good behaviour. Parents can then convert these stars into monetary rewards and save them, fostering a healthy attitude towards earning and saving.

Another feature, Rooster Labs, offers insights and tips on how families can make informed decisions about managing money. It includes resources like quizzes, worksheets, and articles to educate both parents and children about financial literacy.

In summary, Natwest Rooster Money’s wide range of features, including the Rooster Card, Virtual Pocket Money Tracker, Star Chart, and Rooster Labs, helps equip children with essential money management skills while providing parents with the tools needed to guide them on their journey to financial independence.

How to Set Up Natwest Rooster Money

To begin the process of setting up a Natwest Rooster Money account, you will need to provide some personal information. This includes your full legal name, date of birth, nationality, address, and email. Additionally, you must give the first name, date of birth, and gender of each child you want to add to the account source.

Once your children’s profiles are created, you can connect your NatWest account and redeem the offer if you are eligible. The Rooster Card subscription is currently available free of charge for NatWest customers, while it normally costs £19.99 a year or £1.99 a month source.

Rooster Money comes with an app that helps you manage your child’s pocket money. The app allows you to set spending limits, make top-ups, and receive real-time notifications about your child’s spending. There’s also a freeze card option, one-time CVV for online shopping, and built-in blockers for added security source.

After your account is set up, you can customise settings for each child, such as allocating funds to different spending categories and monitoring their progress. Encourage your children to manage their own accounts, as this helps them gain firsthand experience in making financial decisions and learning about budget management source.

Remember to explore all the features of the Rooster Card, such as assigning chores for your children to complete, which can help them earn extra pocket money. Rooster Money is a practical and effective way to teach children about personal finance and instil responsible, good money habits, from an early age.

How to Use Natwest Rooster Money

NatWest Rooster Money is a platform designed to help children develop money confidence through various tools and resources such as pocket money tracking and a prepaid debit card. This section will briefly overview the main features of Natwest Rooster Money and how to use them effectively.

Making Transactions

With the Natwest Rooster Money Kids’ Prepaid Debit Card, children can make transactions both online and in-store, while parents maintain control and oversight. To transfer funds to the child’s bank account, parents can set a specific day for allowances and monitor their kids’ spending and saving. This gives children the freedom to make their own decisions while providing parents with the necessary information to guide and support their child’s financial learning.

Setting Saving Goals

Another essential feature of NatWest Rooster Money is the ability to divide money into spend, save, and give pots, thereby encouraging thoughtful spending and helping children understand the value of money. By using the ‘Rooster Money Pocket Money App’, children can actively set saving goals for themselves, and parents can track and support their progress.

Through the effective use of making transactions and setting saving goals, Natwest Rooster Money provides parents with the tools to help their children grow and maintain healthy financial habits.

Security and Privacy of NatWest Rooster Money

NatWest Rooster Money takes security and privacy seriously. The personal information of users, including children, is protected through a stringent privacy policy. They ensure compliance with privacy regulations by having Kids Privacy Assured by PRIVO: COPPA Safe Harbor Certification.

The Rooster Money app offers a secure platform for children to learn about money management while giving parents the ability to control account amount and oversee their child’s spending. The app comes with a freeze card option, allowing parents to lock the card instantly if it is misplaced or misused.

Additionally, measures like one-time CVV for online shopping and built-in blockers provide an added layer of security. These features prevent unauthorised transactions and help children master responsible spending habits.

For data transfers, NatWest Rooster Money takes extra precautions to maintain the security of users’ personal information. Any international data transfers must adhere to robust security policies and practices, in line with the privacy policy.

The app also adopts a transparent approach regarding data retention and users’ rights. Users can review their rights and learn how data is stored and managed in the privacy policy, ensuring compliance with data protection regulations.

Eligibility and Requirements

To be eligible for the NatWest Rooster Money offer, certain eligibility criteria apply must be met. Firstly, the applicant must be a NatWest account holder and should be over 18 years of age. They must also be a resident of the United Kingdom and registered for either mobile or online banking.

The NatWest Rooster Money Card Subscription is designed for children aged between 6 and 17 years old. Parents or guardians must be aware of the age restrictions to ensure their children can avail of the Rooster Card. It is essential for the parent or guardian to be 18+ and a UK resident to participate in the programme.

Moreover, eligible NatWest customers can receive a free Rooster Card Subscription offer, which includes up to three Rooster Cards for their children. However, please note that other fees may apply depending on the usage of the cards.

In conclusion, interested parties must adhere to the eligibility criteria and requirements set by NatWest, particularly eligibility criteria regarding age, residency, and affiliation with the bank. Observing these guidelines will enable customers to enjoy the benefits of the NatWest Rooster Money programme, helping them teach their children about financial responsibility and better pocket money management.

Benefits and Limitations of Natwest Rooster Money

Natwest Rooster Money is a valuable tool for teaching children about money management and providing parents with control over their children’s spending. The service offers a range of features, including a variety of tiers and services suitable for children as young as 4 years old[^1^]. Natwest Rooster Money is also an accessible and straightforward way to educate children about money, which proves to be a significant advantage.

One of the primary benefits of Natwest Rooster Money is the control it offers parents, without being too restrictive for children. Parents can set limits, top up the accounts, and receive real-time spend notifications through the Rooster Money app[^2^]. Additionally, the service offers security features such as a freeze card option, one-time CVV for online shopping, and built-in blockers[^2^].

Another advantage is that the Rooster Card subscription is now free for NatWest customers; otherwise, it would normally cost £19.99 a year or £1.99 a month[^2^]. This relatively low fee is a positive aspect of the service.

Conclusion

In conclusion, NatWest’s Rooster Money is more than just a financial app for kids; it’s a valuable tool that empowers young minds with essential money management skills. Through its user-friendly interface, customizable features, and educational resources, Rooster Money makes learning about finances fun and engaging. Whether you’re a parent looking to teach your children financial responsibility or a child eager to start saving and budgeting, Rooster Money offers a practical and enjoyable way to achieve those goals. With this innovative app, NatWest is contributing to the financial education of the next generation and fostering responsible money habits that will serve them well throughout their lives. So, take the first step in your child’s financial journey with Rooster Money by NatWest today and set them up for a brighter financial future.