Trading 212 Review: A Comprehensive Look at the Platform’s Features and Performance

Trading 212 is a popular mobile trading platform that offers zero-commission trading on a vast range of instruments, including stocks, forex, and cryptocurrencies. Founded in 2004, the platform has quickly gained popularity among traders of all skill levels due to its user-friendly interface and powerful features.

In this blog, we will provide a comprehensive Trading 212 review, covering all aspects of the platform, including its investment options, account types, fees, and customer service.

The platform is regulated by the UK’s Financial Conduct Authority (FCA), which ensures that Trading 212 adheres to strict standards of security and transparency. With over 13,000 users choosing the platform in the last six months alone, it is clear that Trading 212 is a popular choice for traders looking for a reliable and trustworthy trading platform.

In this review, we will explore the platform’s pros and cons and provide our honest opinion on whether Trading 212 is the right choice for your trading needs.

Key Takeaways

- Trading 212 is a popular mobile trading platform that offers zero-commission trading on a vast range of instruments, including stocks, forex, and cryptocurrencies.

- The platform is regulated by the UK’s Financial Conduct Authority (FCA), ensuring that Trading 212 adheres to strict standards of security and transparency.

- In this comprehensive Trading 212 review, we will explore the platform’s investment options, account types, fees, customer service, and more.

Overview of Trading 212

Trading 212 is a popular trading platform that offers commission-free trading on a range of financial instruments, including stocks, forex, and the cryptocurrency market. It was founded in 2004 and is headquartered in London, UK. The platform has gained a reputation for its user-friendly interface, low fees, and wide range of trading options.

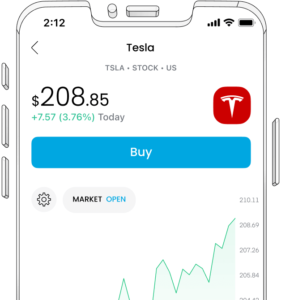

One of the key features of Trading 212 is its intuitive web and mobile trading platforms. The platforms are designed to be easy to use, even for beginners, and offer a range of tools and resources to help traders make informed decisions. The mobile app is particularly popular, with a high rating on both the Apple App Store and Google Play Store.

Another advantage of Trading 212 is its low fees. The platform offers commission-free trading on a range of instruments, including stocks, forex, and cryptocurrencies. This means that traders can buy and sell assets without incurring any additional costs, which can save them a significant amount of money over time.

Trading 212 is also known for its wide range of trading options. The platform offers access to over 1,800 stocks, as well as a range of forex pairs, commodities, and cryptocurrencies. This means that traders can diversify their portfolios and take advantage of different market conditions.

Overall, Trading 212 is a popular and well-regarded trading platform that offers commission-free trading on a wide range of financial instruments. Its user-friendly interface, low fees, and wide range of trading options make it a popular choice for traders of all levels of experience.

Platform and Interface

Trading 212’s platform is user-friendly and easy to navigate, making it an excellent choice for beginners. The platform is available in both web and mobile versions, with the mobile version being particularly well-designed. The web version is also easy to use, with a clear and simple layout that makes it easy to find what you’re looking for.

One of the standout features of Trading 212’s platform is the ability to trade commission-free. This means that users can trade stocks and ETFs without having to pay any commission fees. This is a significant advantage, particularly for those who are just starting and may not have a lot of capital to invest.

The platform also offers a range of trading tools and features, including a customizable watchlist, real-time charts, and a news feed. The platform’s charting tools are particularly impressive, with a range of technical indicators and drawing tools available.

In terms of security, Trading 212’s platform is fully regulated by a number of financial regulatory bodies, including the FCA and CySEC. This means that users can be confident that their funds are safe and secure.

Overall, Trading 212’s platform and interface are well-designed, easy to use, and packed with features. The ability to trade commission-free is a significant advantage, particularly for beginners. Trading 212 is also featured in the best investment apps blog because of its simple to use interface for beginners.

Investment Options

Trading 212 offers a range of investment options for its users. These include stocks and shares, forex, cryptocurrencies, and commodities.

Stocks and Shares

Trading 212 provides access to a wide range of stocks and shares from around the world. Users can invest in popular companies such as Apple, Amazon, and Google, as well as smaller companies that may have potential for growth. The platform offers commission-free trading for all stocks and shares, making it an attractive option for investors who want to minimise their costs.

Forex

Forex, or foreign exchange, is the largest financial market in the world. Trading 212 allows users to trade forex pairs from around the world, including major pairs such as EUR/USD and GBP/USD, as well as minor and exotic pairs. The platform offers tight spreads and leverage of up to 1:300, allowing users to maximise their potential profits.

Cryptocurrencies

Trading 212 also offers users the ability to trade cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The platform allows users to trade both long and short positions, and offers leverage of up to 1:2 for cryptocurrencies. Trading 212 also provides users with real-time market data and analysis to help inform their trading decisions.

Commodities

Finally, Trading 212 provides users with the ability to trade a range of commodities, including gold, silver, oil, and natural gas. The platform offers commission-free trading for all commodities, and allows users to trade both long and short positions. Trading 212 also provides users with real-time market data and analysis to help inform their trading decisions.

Overall, Trading 212 offers a wide range of investment options for users to choose from. With commission-free trading, tight spreads, and leverage options, the platform is a popular choice for investors looking to maximise their potential profits.

Account Types

Trading 212 offers three types of accounts: CFD Account, Invest Account, and ISA Account.

CFD Account

A CFD (Contract for Difference) account allows traders to speculate on the rising or falling prices of financial instruments without owning the underlying asset. Trading 212 offers a range of CFDs, including forex, stocks, indices, commodities, and cryptocurrencies. The CFD account has no commission and offers leverage of up to 1:30 for retail clients and up to 1:500 for professional clients.

Invest Account

An Invest Account allows traders to buy and own shares in a company. Trading 212 offers over 3,000 stocks and ETFs to invest in. The Invest Account has no commission, and traders can invest with as little as £1. Trading 212 also offers fractional shares, which allows traders to invest in a part of a share, making it more affordable.

ISA Account

An ISA (Individual Savings Account) account is a tax-efficient way to invest in the UK. Trading 212 offers a Stocks and Shares ISA, which allows traders to invest up to £20,000 per year tax-free. The ISA account has no commission, and traders can invest in over 3,000 stocks and ETFs. Trading 212 also offers fractional shares in the ISA account.

Trading 212’s account types offer a range of options for traders, from those who want to speculate on prices without owning the underlying asset to those who want to invest in shares or use a tax-efficient account.

Fees and Charges

Trading 212 is known for its low fees and charges, making it an attractive option for investors looking to keep their costs down. Here’s a breakdown of the fees and charges you can expect when using Trading 212:

Trading Fees

Trading 212 does not charge any commission on trades for stocks, ETFs, or cryptocurrencies. This means that investors can buy and sell these assets without incurring any fees. However, there are some fees to be aware of when trading CFDs and forex. For CFDs, Trading 212 charges a spread, which is the difference between the buy and sell prices. For forex trades, Trading 212 charges a small commission.

Account Fees

Trading 212 does not charge any account fees, such as maintenance or inactivity fees. This means that investors can keep their accounts open without worrying about incurring any additional costs.

Deposit and Withdrawal Fees

Trading 212 does not charge any fees for deposits or withdrawals. However, investors should be aware that their bank or payment provider may charge fees for these transactions.

Currency Conversion Fees

Trading 212 allows investors to hold multiple currencies in their accounts. However, when converting currencies, Trading 212 charges a small fee. The fee varies depending on the currency pair being traded.

Other Fees

There are a few other fees to be aware of when using Trading 212. For example, there is a fee for using the “Instant Execution” feature, which allows investors to execute trades immediately at the current market price. Additionally, there is a fee for using the “Guaranteed Stop Loss” feature, which allows investors to limit their potential losses on a trade.

Overall, Trading 212’s fees and charges are relatively low compared to other brokers. However, investors should be aware of the high risk and fees associated with CFDs, forex, and currency conversions. It’s important to read the fine print and understand all of the fees and charges before opening an account with Trading 212.