What is Updraft?

Updraft is a personal finance company, created and backed by Natwest which aims to solve the problem of the rising cost of reliance of overdraft facilities. This is a downloadable app which helps millennials and the Gen-Z manage their money in a more efficient manner. Updraft uses an open banking system which allows people to see and manage all of their accounts in one place. It also offers the transparency to see and track your credit history, credit rating and current credit score all on an intuitive dashboard.

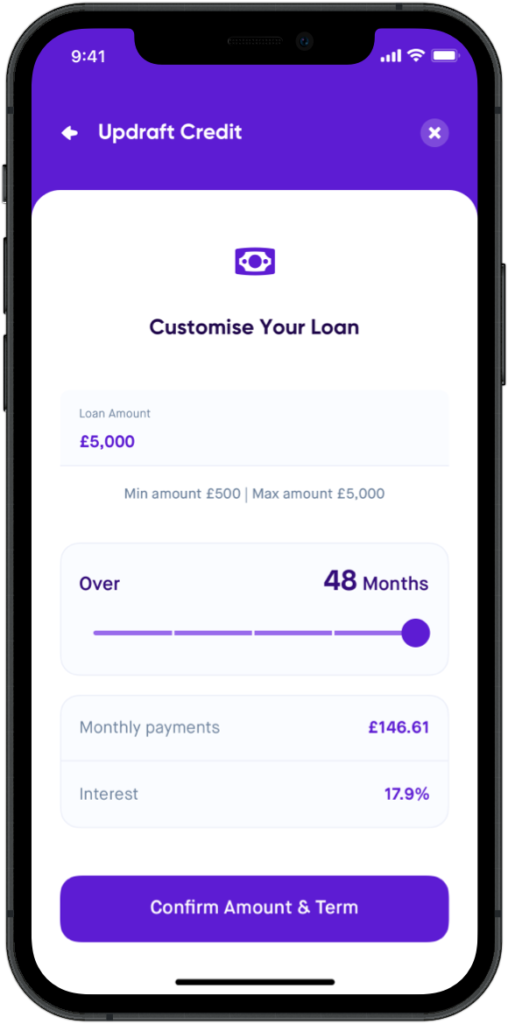

Once you connect your bank and it appears as if you are paying over the amount needed on an overdraft or on credit cards, Updraft has built in AI to then offer customers ‘Updraft Credit’. This feature is a consumer loan offered to customers designed to replace a traditional overdraft and credit lending facility.

With the rise in cost of living, and the average total debt per household in the UK being £65,946 – Updraft aims to help the UK adult population reduce their reliance on overdrafts and overdraft fees with their Updraft Credit product.

How does Updraft work?

To get started using Updraft, you firstly need to download the app and sign up. Once the application process is out the way, you need to authorise the connection to your existing bank accounts and cards using the Open Banking API embedded feature. This will benefit you as a customer by seeing alerts when you are reducing your overdraft, steps are being made to consolidate your debt but also when you are at risk of overspending on all your accounts.

In the event you do overspend during a month, instead of your bank automatically emailing you and arranging an unplanned or planned overdraft, Updraft will notify you and offer a low interest loan, so you can utilise the loan and access the money without incurring expensive overdraft associated costs.

With this feature, you can see how it impacts your financial profile by checking the free credit report and credit rating feature. This free credit score feature will help you as you will also receive tips to support your spending habits so you can focus on improving your credit report and increase your savings as part of your life goals.

Do I need Updraft?

If you frequently rely on lenders, Updraft may be what you need. However, if you use credit cards and make payments monthly Updraft is not necessary.

Updraft is suitable for individuals who are regularly overdrawn on their current accounts and for those who are paying too much interest on credit cards and loans. The loans offered by Updraft can be used to consolidate an existing loan and expensive forms of credit to boost your credit profile.

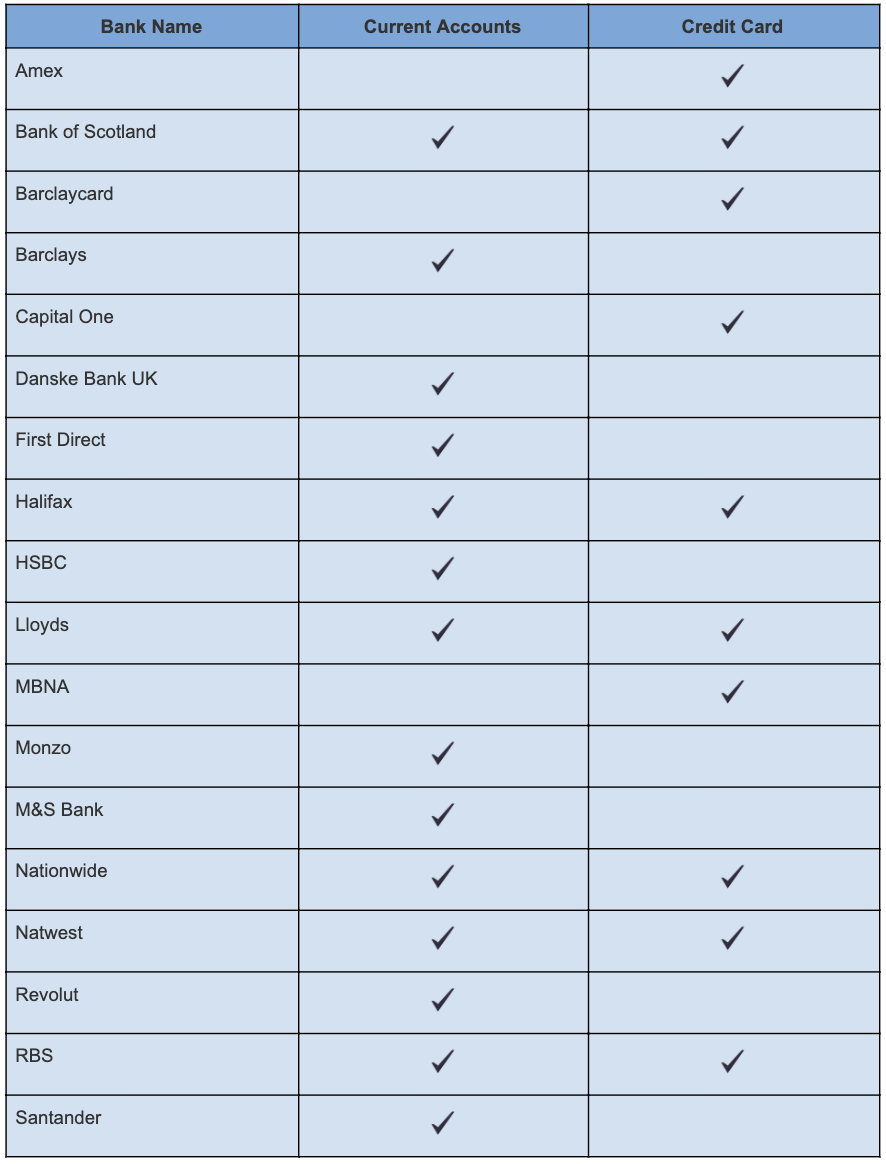

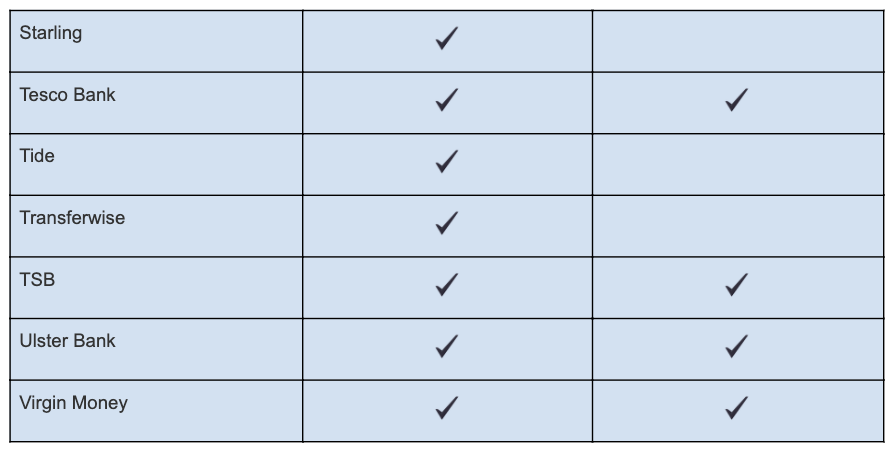

What banks and accounts work with Updraft?

All current accounts and credit card providers are listed and ticked below. Truelayer, who provide account information services are constantly working hard to add new banks to this list. It is highly recommended you check back on Updraft to see if new providers are added to this list. Please note, Updraft will not work with business accounts, so if you are a small business owner, consider other options for lending arrangements.

How much does Updraft cost?

Updraft offers a free app to download on the iOs and Android market. There is no price pay when downloading the app or to use the app. Fees for Updraft are linked to their loan facility. If you take out a Updraft loan, the representative APR is 17.9%, but the specific cost of your loan will depend on a wide range of factors. These include your credit score and the loan term. In some instances, it may make more sense for you to get a traditional overdraft, as some banks offer interest free overdraft arrangement. Other available features are currently free to encourage users improve their finances.

How do I apply for Updraft Credit?

Once you download the app and register. Anybody can apply for an Updraft loan through the app. You will need to connect your bank accounts – and the account which you are aiming to consolidate the debt.

How is my Updraft Credit Score determined?

Like many financial lending institutions, Updraft has an arrangement with TransUnion. With this partner arrangement, Updraft pulls users credit profile information from the TransUnion reference agency to provide visibility to users of their credit score and report. All lending arrangements given will be subject to a users credit profile.

What to consider when evaluating a Loan Provider?

When evaluating a loan provider, it’s important you research the company’s reputation, interest rates, fees, and repayment terms. Here are a few other factors to consider:

- Reputation: Look for reviews and ratings from trustworthy sources, such as the Better Business Bureau, Consumer Financial Protection Bureau, TrustPilot and online forums. Consider the company’s overall customer satisfaction, response to complaints, and whether it’s been involved in any legal disputes.

- Interest Rates: Check the lender’s interest rates and compare them to other lenders in the market. Remember that interest rates can significantly affect the total cost of the loan.

- Fees: Consider any fees associated with the loan, such as origination fees, prepayment penalties, or late fees. These can increase the total cost of the loan, so be sure to understand them thoroughly.

- Repayment Terms: Review the loan’s repayment terms, including the length of the loan, payment schedule, and options for early repayment. Make sure you understand the total amount you’ll pay over the loan’s life.

Overall, be sure to do your due diligence when researching a loan provider, and don’t hesitate to ask questions or seek clarification on any aspects of the loan.

What are the Review ratings of Updraft?

Updated: 26th January 2024

We recently checked the ratings of Updraft and on Trustpilot we can see updraft rating review stands at a 4.6 rating.

Read more about what users have to say on Trustpilot.

Frequently asked questions

Will an Updraft loan affect my Credit Score?

Yes – If you take a new loan this will be on your report. Limit the impact on your credit score through the number of accounts you open within a 6 month stretch. Lower is better: if you need a new credit account, aim for no more than 1-2 opening within this time period. Go steady with applications too, each one leaves a hard search on your report and lenders don’t like to see too many of these.

How do I apply for a Updraft loan?

You can apply for a loan via the app. Click on the Dashboard. go to Loans and then follow the sign up process to apply for a loan.

Can I repay my Updraft Loan early?

Yes, absolutely. You can repay in full at anytime without fees or penalties, ever. You can find the payment details on your Updraft Credit page by tapping ‘Make a Payment’ then just make a transfer from your bank account.

How do I change the bank account I use to connect with Updraft?

You can connect and disconnect any bank or credit card accounts at any time.

Go to your Profile (icon in the bottom right corner) then select Linked Accounts. You can then add an account or swipe left to delete any you no longer want linked.

- Tags:

- updraft

- updraft review