Wealthyhood Review: Is This Investment App Worth Your Time?

When it comes to investing in the UK, there are two extremes: either you go it alone and make all the investment decisions yourself, or you use an investment app where experts manage everything for you. However, Wealthyhood aims to sit right between these two options. It guides users through the right way to invest successfully for the long term while still allowing them to make all the investment decisions themselves rather than relying on the experts.

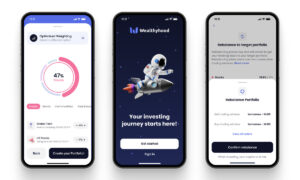

Wealthyhood is perfect for beginners and those who aren’t experts in investing but still want to learn and manage their own investments. It helps users assemble the right investment portfolio for them and continually optimize it for long-term success. The app is mobile, available on both Apple and Android, and completely commission-free. Users only pay a monthly fee of £1 and can start with just £10. Wealthyhood is highly rated, with 5 stars on Apple, although it doesn’t have many reviews yet.

Key Takeaways

- Wealthyhood aims to sit in the middle of investment app options, guiding users through the right way to invest for the long-term while still allowing them to make their own investment decisions.

- Wealthyhood is perfect for beginners and those who want to learn and manage their own investments, with a commission-free model and a monthly fee of £1.

- Wealthyhood is highly rated on Apple, with 5 stars, and offers a mobile app on both Apple and Android platforms.

Is Wealthyhood Good for Beginners?

Wealthyhood is an investment platform that is built specifically for beginners. It is perfect for those unsure about investing and want to get started. The platform helps users build the right investment strategy that suits their goals, which is often to grow their money over the long term.

Wealthyhood guides users through every step of the way, all through the easy-to-use app. It helps users buy the right investments that suit their goals and continually monitor and improve them over time. Users can also start investing with just £10 and invest as little as £1 into each investment.

Wealthyhood is completely commission-free, so users’ money won’t be eaten up in fees. Additionally, there are some great guides on investing and learning the basics of investing, which are in partnership with Finimize, one of the best investment apps for easy-to-understand financial news and analysis.

Overall, Wealthyhood is a great option for beginners who want to start investing. It provides a user-friendly platform and helpful resources to guide users through the process.

How Wealthyhood Works

Wealthyhood is an investment app that guides users through the process of investing in different asset classes, including stocks and shares, bonds, commodities, and property. The app allows users to invest in the US or globally and allows them to choose which industries they want to invest in.

Once users have selected their investment preferences, Wealthyhood uses its algorithm to pick out the best investment options for them to create a professional investment portfolio that is tailored to their interests and goals. The app mostly invests in exchange-traded funds (ETFs), which are groups of investments all pooled together into one easy-to-manage and cheaper-to-buy investment.

Users can also adjust the weighting of each investment in their portfolio, but Wealthyhood suggests the best weighting for them. This makes it easy for users to manage their investments and meet their long-term goals.

Overall, Wealthyhood is a user-friendly investment app that allows users to invest in different asset classes and industries with ease. The Wealthyhood app’s algorithm ensures that users have a professional investment portfolio that is tailored to their interests and goals.

Wealthyhood Investment Features

Auto Investment

Wealthyhood offers an auto-investment feature that allows investors to automatically split their investment between all the investments in their portfolio. This feature is particularly useful for investors wanting to invest more monthly money. Once the auto-investment feature is set up, investors can sit back and relax as their money is automatically invested in their chosen investments. The auto-investment feature will stick with the weighting that was originally set for the portfolio.

Portfolio Rebalancing

As an investor’s portfolio grows, the weighting of the investments in the portfolio may change. This means the strategy no longer aligns with the investor’s goals. Wealthyhood offers a portfolio rebalancing feature that automatically adjusts the portfolio back to the agreed weighting. This feature involves buying or selling investments to return the percentage to the right ratio. Investors can rely on Wealthyhood to help them keep the right amount of risk within their portfolio to suit their goals.

Overall, Wealthyhood’s auto-investment and portfolio rebalancing features make it easy for investors to manage their portfolios. Investors can set up the auto-investment feature and let Wealthyhood do the work for them. Wealthyhood’s portfolio rebalancing feature ensures that the portfolio remains aligned with the investor’s goals and risk tolerance.

Range of Investments

The range of investments available on this platform is good enough for a beginner to build a diverse portfolio. The platform offers investment funds, also known as ETFs, in all the major markets such as global, UK, and US stocks. Additionally, there are options for smaller companies, technology companies, healthcare, pharmaceuticals, real estate, and more.

Individual stocks and shares cannot be purchased and must be bought within an investment fund. This is because buying individual stocks alone is very risky, and using a portfolio of companies via an investment fund is much safer for long-term investing. The platform offers a wider mix of companies, which helps to reduce the risk of being affected by the value of any particular company changing in value.

The platform offers a good range of bonds from across the world. However, when it comes to commodities, there is only gold. This is not a problem for beginners as most portfolios that have commodities within them will just have gold, unless the investor is a bit more advanced.

Regarding property, only two options are available: US-based or from across the world as investment funds. Cryptocurrencies cannot be purchased on this platform; a specific crypto exchange must be used instead.

In conclusion, the range of investments available on this platform is good enough for beginners to build a diverse portfolio. The platform offers investment funds in all the major stock markets around, a good range of bonds from across the world, and gold as the only commodity. There are only two options available for property, and cryptocurrencies cannot be purchased on this platform.

Investment Account Options

Wealthyhood currently only offers a General Investment Account (GIA) for investors in the UK. While this type of account does not offer tax-free benefits, it is a standard investment account that anyone can open. Capital Gains Tax is only applicable if an investor makes more than £6,000 per year in profit when selling an investment. It’s important to note that this tax only applies to the profit made and only when an investor sells an investment.

In the event that an investor does make a profit of more than £6,000, they will pay either 10% or 20% Capital Gains Tax depending on their income tax bracket. Basic rate taxpayers, earning less than £50,270 per year, will pay 10% Capital Gains Tax on their investments. Meanwhile, higher rate taxpayers will pay 20%.

Wealthyhood has announced that it is currently working on a Stocks and Shares ISA, which will offer tax-free benefits. This type of account allows investors to make tax-free profits forever. Other account options in the UK include self-invested personal pensions (SIPPs) and Lifetime ISAs, which are not currently available with Wealthyhood.

It’s important for investors to understand the different types of investment accounts available to them and to choose the one that best suits their needs. Wealthyhood’s current offering of a GIA provides a standard investment account option for beginner investors or those who are just starting out and are not yet making significant profits. However, investors who are looking for tax-free benefits may want to wait until Wealthyhood releases its Stocks and Shares ISA.

Customer Support

The current customer support option for this service is limited to email communication only. There is no live chat feature available through the app, nor is there a phone number to call. However, response times for email inquiries have been reported as good. Additionally, the service offers a comprehensive FAQ section, which may answer many of the frequently asked questions.

Is Wealthyhood Safe?

Wealthyhood is a safe investment app that has been approved by the Financial Conduct Authority (FCA) to manage users’ money. The app offers protection for users’ money through the Financial Services Compensation Scheme (FSCS), which provides up to £85,000 in case of any mishap such as Wealthyhood going out of business. Additionally, users’ investments are held with a large bank, separate from Wealthyhood, all in their name, and can only be returned to them, providing even more protection. Overall, users can feel confident and secure using Wealthyhood app for long term with their investments.

Wealthyhood Pros and Cons

Pros

- Suitable for beginners

- Commission-free trading

- Customizable professional investment portfolio

- Guided process

Cons

- Limited investment options

- No Stocks & Shares ISA

- No personal pension

- No live-chat support

Wealthyhood is a beginner-friendly investment app that offers commission-free trading and a guided investment process. Users can customize their investment portfolio to fit their needs. However, the app has a limited range of investment options, lacks a Stocks & Shares ISA and a personal pension, and does not offer live-chat support.

Our Thoughts

Wealthyhood is a commission-free investment app that allows beginners to invest like professionals. It provides users with educational resources to help them make informed investment decisions. The app is user-friendly and easy to navigate. It is also affordable, with a monthly subscription fee of just £1.

While Wealthyhood does not currently offer a tax-free Stocks & Shares ISA, it is expected to be available soon. Additionally, the investment range could be expanded, but for beginners, the app offers everything needed to get started.

For those who prefer to manage their own investments or have experts manage their investments for them, there are better options available. However, Wealthyhood is an excellent choice first investment, for those who want to invest in the right way for the long term.

Overall, Ambitious Investor rates Wealthyhood with a solid 4 stars. It is a great option for beginners who want to learn about investing and grow their wealth over time. If you are interested in getting started with Wealthyhood, you can visit their website.

Happy investing!

Frequently Asked Questions

What is Wealthyhood and how does it work?

Wealthyhood is a DIY wealth-building app that allows long-term investors to create a custom investment portfolio. The platform is designed to cater to new investors with little to no market experience. Wealthyhood offers commission-free investing in Exchange-Traded Funds (ETFs), which are a basket of securities that track an index. The platform is easy to use and guides investors through the entire investment process.

What are the benefits of using Wealthyhood for investing?

Wealthyhood offers several benefits for investors, including commission-free investing in ETFs, a custom professional investment portfolio, and a user-friendly interface. The platform is perfect for beginners and guides investors through the entire investment process. Wealthyhood also offers a range of educational resources to help investors make informed investment decisions.

Can I invest in ETFs through Wealthyhood?

Yes, Wealthyhood offers commission-free investing in ETFs. ETFs are a type of investment fund that holds a basket of securities, such as stocks, bonds, or commodities. ETFs are designed to track the performance of a specific index, such as the S&P 500.

How does Wealthyhood compare to other investment platforms like Wealthify and Freetrade?

Wealthyhood offers commission-free investing in ETFs, a custom professional investment portfolio, and a user-friendly interface. Wealthify offers a range of investment options, including stocks and shares ISAs and personal pensions. Freetrade offers commission-free investing in stocks and ETFs. Each platform has its own unique features and benefits.

Is Wealthyhood a reliable and trustworthy investment platform?

Wealthyhood is a new investment platform on the scene, so it is difficult to assess its reliability and trustworthiness. However, Wealthyhood is regulated by the Financial Conduct Authority (FCA) in the UK, which provides some level of assurance for investors.

What is the valuation of Wealthyhood and how does it compare to similar companies?

Wealthyhood is a new company and its valuation is not publicly available. However, Wealthyhood is competing in a crowded market with other investment platforms, such as Wealthify and Freetrade. The success of Wealthyhood will depend on its ability to differentiate itself from its competitors and offer unique features and benefits to investors.