Inside IR35, Outside IR35, Contracting, Umbrella Company, Interim Contractor.

Didn’t know about these terms, what they meant and how I would be able to take advantage of contracting roles until 7 years into my career as a Contract & Commercial Manager.

I wish these were given more exposure and explained at various careers fairs I attended and during years I undertook internships. Unfortunately, as the first in my family to complete a university degree and go down the corporate route, I also did not have anyone to really ask.

Being a typical 9-5’er I went to work Monday – Friday and got paid a salary with a payout on the 28th of every month. This was good but I eventually realised there were other ways to make an income as a specialist and earn a daily rate.

Everything changed for me in 2019 when I applied for a job on Indeed.com, had no idea it was actually a contracting role, interviewed and was offered a job at Capita (a large consulting, digital and transformation business process services company in the UK). This came at a great time because I was working for a Spanish Bank, the name of which I won’t mention which got themselves in a big issue and laid off multiple staff members – of which, I was one of them only 1 year into the permanent role! Lol, talk about ‘job security’ right…

Before we look at what inside IR35 and outside IR35 mean, let me explain to you what Contracting is.

How does Contracting Work in the UK?

Contracting working practices work similar to that of freelancers. A Contractor provides work to an end client under a set of defined terms, usually called an assignment with a set of deliverables. In a contracting engagement you are considered to be self-employed and typically charge a company a day rate. As a contractor, you invoice for your time and if you do not work, you do not get paid.

In truth, there are some key characteristics to that of a freelancer however there are also some key differences. As a freelancer, people usually operate as a sole trader while as a contractor you tend to set up a limited company, become a director and shareholder and also provide the services to the end client. This is what is also referred to as a Personal service companies (PSC) – more on this later.

And this is where the UK Law decided to intervene. The government realised contractors were enjoying a few tax reliefs not offered to employees and create legislation to determine if contractors and PSC’s are true genuine businesses or actually disguised employees. Simply put, the government realised contractors were making too much money and using tax avoidance strategies to their advantage to make and keep more money – they wanted a piece of the contractor pie – typical right?).

What does IR35 (Off-Payroll working) mean?

The off-payroll working rules ensure that contractors providing assignment based work pay the same Income tax and National insurance as an employee would. The rules apply if the contractor provides services to an end client through their own limited company and would have been the same as an employee. These are the policies that underpin contracting working practices in the UK.

What does outside IR35 mean?

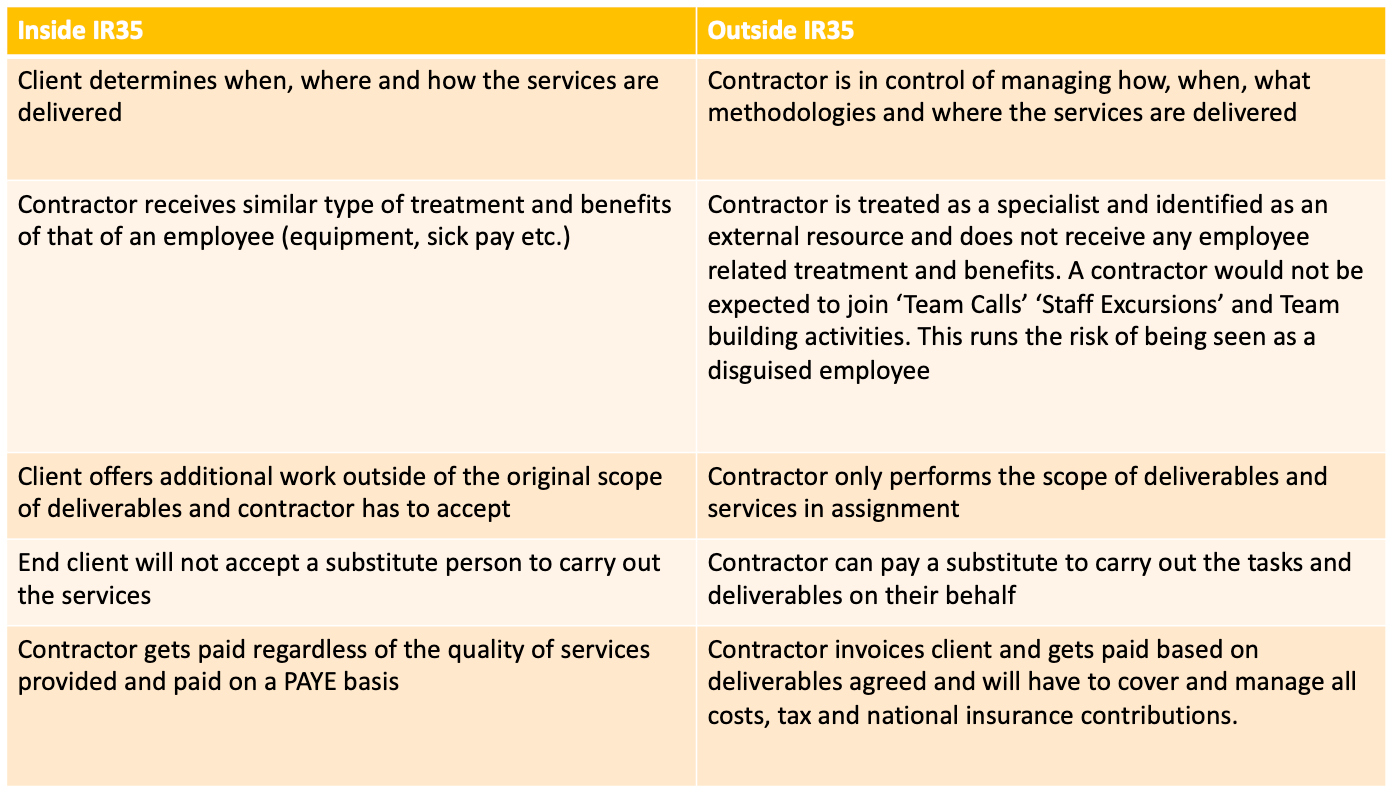

To be ‘outside IR35’ means that you are operating as a true genuine business entity and therefore operating outside of the IR35 rules and not seen as a ‘disguised employee’. It also means you are in control of managing when, where and how services are delivered. A Outside IR35 operation means that the worker via the engaged company is classified as external resource and does not receive employee-related treatment and benefits (like discounted gym membership and private healthcare) and other perks some companies offer employees.

Having the outside IR35 status determination statement means you carry out the work specified in an assignment work order. Additionally, you can substitute yourself for another worker within your company to complete deliverables on your behalf. If operating outside of the IR35 status the contractor receives payments based on deliverables agreed and will have to cover and manage all costs, tax and national insurance.

How to work through a limited company in an outside IR35 role?

In my experience and the last 4 years of my career, working through a limited company makes the most sense and is often expected by end clients in the public sector and private sector. Setting up a limited company is easy, you can get set up with a limited company quite quickly.

This gives you a greater degree of control when managing income generated from providing services during assignments. It is also one of the best tax efficient ways to operate because it allows proper tax planning which you can discuss with your accountant (you will need one).

Being in an outside ir35 position has benefits, however on the flip side, you will have way more admin to take care of. You are a business owner and this means you will have to make sure your tax records are correct. It also means everything from what you pay yourself in salary, payroll, dividend allocation, corporation tax, vat, end of year accounts and business insurance like professional indemnity insurance, you will need to look after.

There are numerous duties directors of limited companies must look after and take reasonable care in doing so. Contractors that set up limited companies and are the director, shareholder and worker are typically called ‘Personal Service Company’. There is no legal definition of PSC’s but if you operate within this structure, you will be seen as a PSC.

To learn more and understand the intricacies of operating a PSC, you should consult an accountant or seek specialist advice from a tax consultant. They will be able to explain the advantages, disadvantages and be able to shed light on financial risks, IR35 enquiries, how paye tax works and potential penalties if found to be inside IR35 following an enquiry or HMRC audit.

What does Inside IR35 mean?

If a role as advertised as ‘insider IR35’ this means that you will be considered for tax purposes as an employee and subject to PAYE. This is similar to being a standard employee, however does have a few differences. In this arrangement the end client determines, when, where and how the service should be delivered.

As an inside ir35 contractor you will receive the same type of treatment like that of an employee when you onboard with a client, such as equipment and a laptop. If engaged in the private sector or medium-large private sector you will not be able to substitute a person to carry out the services. You will be paid regardless of the quality of services provided and paid on a salary or PAYE basis, even though this may look attractive in the form of a day rate.

If you secure an inside ir35 role, the fee payer, typically a recruitment agency will be required to deduct tax and national insurance contributions at source. A recruitment agency will often point you in the direction of an umbrella company, because they may not be set up to manage contractors working through payroll. In this scenario, the umbrella company acts as the employer and provides your pay slips and pay for a fee.

Working through an umbrella company inside IR35

The opposite from operating outside IR35, means you will be inside and you will need to opt to work through an umbrella company. The working practices of an inside ir35 contractor provides an element of flexibility because contracts are typically 3, 6 or 9 months – in the situation of a maternity cover position.

However, when you contract via an umbrella company you get rights of a company employee; sick pay, holiday pay and even access to a pension enrolment scheme.

The downsides are that you are taxed at source and you will not be able to be promoted in this type of role. If your goal is to go up the ranks in your profession, being an actual employee would make better sense in the long term as the employment taxes are the same.

Comparison Table of Inside IR35 vs Outside IR35

Best Websites to Find Contract Work

Now we have looked at the difference between ‘outside ir35’ and ‘inside ir35’ roles. Let’s look at the top 5 best websites to find contract work. My favourite, and I am biased because my background is in Contract, commercial and procurement are as follows:

- Indeed.com

- Reed.com

- Totaljobs.com

- Securityclearedjobs.com

These are my favourite simply because I have secured a position from one of these sites, had an interview or had good conversations with recruiters from applying for a role via these websites. Depending on the industry and sector you specialise in there more than likely be other websites to invest time looking for opportunities.

Best Paying Contracting Roles

Since becoming a contractor, I have seen a broad range of roles paying anywhere from £200/per day – £1,500/per day. There is a lot of money to make and like everything, this is based of experience and value of skillset to an organisation. Some of the best contracting industries that pay well are:

- Software Development – eg. Full Stack Developer day rate is typically £590/day

- Business Intelligence – e.g. Business Analyst can earn around £500/day

- Project Managers/Contract Managers can earn around £600/day

- Cyber Security – e.g. Cyber Security Architects can earn £900/day

- QA/Testing – e.g. Quality Assurance Testers can earn £600/day

Frequently Asked Questions

How to Check Employment Status for Tax Purposes

Use the CEST Tool to find out if you should be classified as an employee (inside ir35) or outside ir35 for tax purposes. The tool can be found here. To understand whether you are inside ir35 or outside ir35, you should answer the questions honestly, think about the engagement and working environment because these will have a huge impact on your tax status.

Is contracting stable?

Based on my experience, contracting does have an element of risk because notice periods are shorter and contracts are usually 3 – 12 months. However, in my experience I have found contracts to always be extended for longer terms and there has always been a demand for contractors in my particular industry.

I also do not believe being permanent is ‘stable’ because I have been made redundant, witnessed friends get furloughed and seen people in my network laid off during the big tech lay off. I do not believe any form of employment is stable – but thats my opinion.

Do I need an accountant as a Contractor

You do not need an accountant at all if you are contracting in an inside ir35 role. In a outside IR35 role, having an accountant is advised, unless you have the skillset to manage your accounts by yourself and via software tools out there like Freeagent (I use freeagent by the way, its pretty good).

Should I avoid inside IR35 contracts?

Ideally yes. Outside IR35 roles make more sense. If you weigh up the pros and cons, if you are thinking of taking a inside IR35 role, you may as well take a permanent salaried job.

Can you work two contracts at the same time?

If you secure two outside IR35 roles, technically you could and I know numerous contractors who do this. This will all depend on the type of role, if they are remote based, there are not many meetings and calls and you can maybe substitute yourself.

Can you get promoted as a contractor?

No. Contractors are specialist. You work with your end client, complete deliverables and once completed leave a client’s organisation. You do not get the other employee benefits of other individuals you may interact with day to day.

How do you get a mortgage as a contractor?

It is a misconception getting a mortgage is harder. Mortgage brokers can either use your tax return information or your contract and day rate information to find suitable lenders to buy a property or invest in buy to lets.

- Tags:

- contracting

- freelancing