Currensea Review: A Comprehensive Look at its Features and Benefits

If you are a frequent traveler, you will understand the importance of arranging travel money, the impact of foreign exchange fees and how you can easily incur additional fees by using the wrong debit or credit card. This is where Currensea comes in, a brand created to help frequent travelers save at least 85% on every transaction while abroad.

Currensea is a travel debit card that aims to make traveling overseas more convenient and cost-effective. The card is linked to the user’s everyday bank account and is designed to eliminate transaction fees when spending in foreign currencies. This is ideal because not only will you get peace of mind knowing you are not absorbing excess fees. Also, because you don’t need to travel with a lot of cash, keep cash in a resort and worry about being robbed or losing money. For these reasons, Currensea is gaining popularity among frequent travelers who want to avoid the high fees charged by traditional banks and credit card companies.

To get a Currensea card, all you have to do is apply for the free card on the website, Currensea. It works by connecting to the user’s existing bank account and providing a debit card that can be used for transactions abroad. The card automatically converts transactions made in foreign currencies into your home currency, eliminating the need for costly currency exchange fees. Currensea also offers competitive exchange rates, so users can be sure they are getting the best deal possible when spending abroad.

What is Currensea?

Currensea is a UK-based fintech company offering a travel debit card linked to a user’s bank account. The company was founded in 2018 by James Lynn and Craig Goulding, both of whom have extensive experience in the financial services industry.

Company Overview

The business’s aim and mission is to make traveling abroad easier and cheaper by removing transaction fees and offering competitive exchange rates. The company’s travel debit card can be used anywhere in the world where Mastercard is accepted and linked directly to a user’s existing bank account. This means that users do not need to open a new bank account or transfer money to a separate account in order to use the card.

Currensea prides itself on transparency and simplicity, with no hidden fees or charges. The company charges a flat fee of £0.50 per transaction, which is significantly lower than the fees charged by most high street banks. In addition, the Currensea app offers real-time exchange rates, so users can see exactly how much they are spending in their home currency. Here’s a table shows how the travel debit card compares to most traditional UK banks.

How Does Currensea Work?

Currensea’s travel debit card offers a number of benefits for travelers, including:

- Flat transaction fee: Currensea charges a flat fee of £0.50 per transaction for overseas charges

- Competitive exchange rates: Currensea offers competitive exchange rates, with no hidden fees or charges. If you are Elite or Premium Plan customer you also benefit from more competitive rates (more on this later)

- Real-time exchange rates: Users can see how much they spend in their home currency, with real-time exchange rates on the app or website.

- Easy to use: The card is linked directly to a user’s existing bank account, making it easy to use and manage.

- Secure: Currensea uses state-of-the-art security measures to protect users’ data and transactions.

Overall, Currensea offers a convenient and cost-effective way for travelers to manage their money abroad. With no hidden fees or charges, competitive exchange rates, and real-time exchange rate information, Currensea’s travel debit card is a great option for anyone looking to save money while traveling.

How to Set Up Your Currensea Account

Download the app or go onto the Currensea website. On the website you can click “Get my free card” and go through the application process which is pretty straightforward. You will need to have an email account, mobile phone and the process is typical to applying for most debit cards. Once you have applied all you have to do is the following:

- Link your existing bank account: Currensea is linked to your existing bank account, so you don’t need to open a new one. You can link any UK bank account to Currensea.

- Top up your Currensea account: Once you’ve linked your bank account, you can top up your Currensea account with GBP. You can do this using a bank transfer or a debit card.

- Manage your account: You can manage your Currensea account using the mobile app. The app allows you to check your balance, view transactions, and top up your account.

Once you have done that, you can enjoy the cost savings when traveling abroad. You can use your Currensea debit card to make purchases and withdraw cash in foreign currencies and you will get the best exchange rate at that moment in time for both purchases and withdrawals.

Currensea Different Plans

The Essential Plan

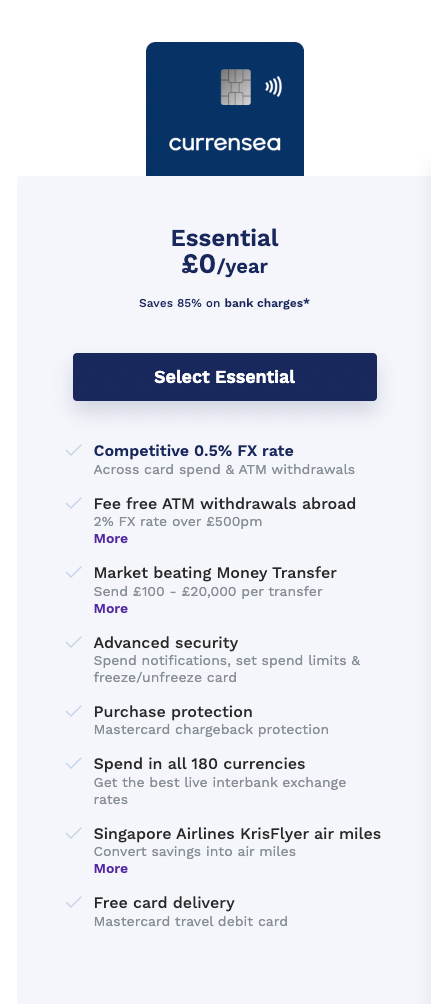

The Currensea Essential Plan will cost you £0/year. These are the benefits of becoming an Essential customer:

The Premium Plan

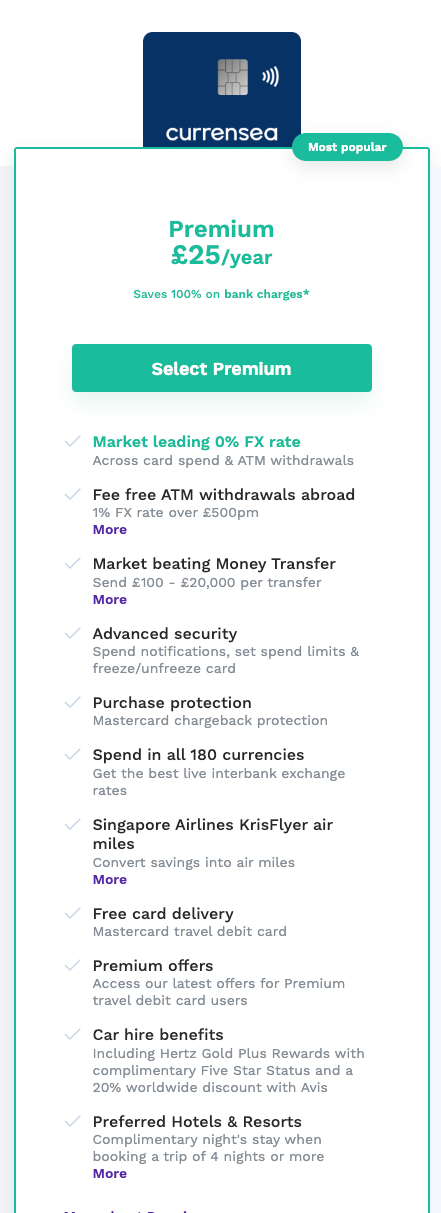

The Premium Plan will cost you £25/year. These are the benefits of becoming a Premium customer:

The Elite Plan

The Elite Plan will cost you £120/year. These are the benefits of becoming an Elite customer:

Benefits of Using Currensea

Currensea is a travel debit card provider offering its users several benefits. Here are some of the benefits of using Currensea:

Convenience

Currensea also offers a mobile phone app that allows you to manage your card and transactions on the go. You can check your balance, view your transaction history, and even freeze your card if you lose it, all from the app.

Security

Another benefit of using Currensea is its security features. Currensea uses Mastercard’s secure payment technology to protect your transactions. This means that your card details are encrypted and kept safe from fraudsters.

Currensea also offers real-time transaction notifications, so you can keep an eye on your card activity and quickly report any suspicious transactions.

Cost Efficiency

Currensea offers super-low foreign exchange fees, making it a cost-efficient option for travelers. The card allows you to reduce your ATM withdrawals and in-person transactions by up to 85%, as per Currensea itself. Additionally, Currensea uses the interbank exchange rate for 16 currencies, which means you get a fair exchange rate without additional fees.

Currensea also offers three different plans: Essential Plan (free), Elite Plan, and the Premium Plan. The Premium plan comes with additional benefits such as higher ATM withdrawal limits and no transaction fees, but it does come with a monthly fee. The free plan is great for occasional travelers who want to save on fees.

Potential Drawbacks of Currensea

Currensea is a travel card with many benefits but has some potential drawbacks that users should be aware of. This section will discuss some of the limitations and customer service issues associated with Currensea.

Limitations

One of the main limitations of Currensea is that it is only available to residents of the United Kingdom. This means that if you are not a resident of the UK, you cannot use Currensea. Additionally, Currensea is linked to your existing bank account, which means that if your current bank account ever is frozen or blocked, you will not be able to use your Currensea card.

Another limitation of Currensea is that it does not offer any rewards or cashback programs. This means you will not earn any rewards or cashback when using your Currensea card. If you are looking for a travel card that offers rewards or cashback, then Currensea may not be the best option for you.

Customer Service Issues

Currensea has received some negative feedback regarding its customer support service. Some users have reported that it can be difficult to get in touch with customer service representatives and that when they do get in touch, the representatives are not always able to resolve their issues.

Additionally, some users have reported issues with their Currensea card being declined, even when there is sufficient funds in their account. This can be frustrating and inconvenient, especially when you are traveling and relying on your Currensea card.

While Currensea has many benefits, it is important to be aware of the potential limitations and customer service issues associated with the card. Considering Currensea, weighing the pros and cons and determining if it is the right option for you is important.

User Experience

According to Trustpilot reviews, users appreciate the transparency and convenience of the service.

One of the most common praises is the instant reminders users receive when they spend and the full transparency of the rate they got. Users do not need to hunt around for the conversion, as they can see it instantly. This feature is particularly useful when buying or booking with brands that do not use sterling directly from the UK.

The app works perfectly, and users receive an email each time they spend, showing the conversion and the saving they made. The card is contactless, and users occasionally need to enter their PIN. According to a Trustpilot review, the card is easy to order, arrives promptly, and works well at cash machines.

Another review mentions that Currensea is the easiest holiday card to be accepted anywhere overseas, and there is an instant return calculation of the rate of exchange. Users love the regular notifications about their spend and how much they have saved using the card.

Overall, users seem to have a positive experience with Currensea, praising its ease of use extra security, transparency, and convenience.

Final Thoughts

In conclusion, Currensea offers a unique and convenient solution for those who frequently travel abroad and want the same way to save on foreign exchange fees. With its low fees and seamless integration with existing bank accounts, Currensea is a great option for those who want to avoid the high fees charged by traditional banks and currency exchange services.

One of the standout features of Currensea is its ability to reduce ATM withdrawals and in-person transactions by up to 85%. This can be a significant cost savings for those who frequently travel abroad and need to access cash or make purchases in foreign currencies.

Another advantage of Currensea is its ease of use. The card can be linked to existing bank accounts and can be managed through a user-friendly mobile app. This makes it easy to track spending and manage finances while on the go.

Overall, Currensea is a reliable and cost-effective option for those who want to save on foreign exchange fees while traveling abroad. Its low fees, ease of use, and seamless integration with existing bank accounts make it a great choice for frequent travelers.

Note: If you are looking for general accounts to help you save more, check out this one we wrote on the best money savings app across the UK.

Frequently Asked Questions

What are the benefits of using Currensea compared to other travel cards?

Currensea provides super-low foreign exchange fees, which allows you to reduce your ATM withdrawals and in-person transactions by 85%. The card offers the best exchange rates and eliminates transaction fees while you travel abroad. It also links directly to your everyday bank account, making it easy to manage your finances while you’re on the go.

How does the Currensea card work?

The Currensea card works like any other debit card. You can use it to withdraw cash from ATMs or purchase at merchants accepting Mastercard. The card is linked directly to your everyday bank account, so you can easily manage your finances while you’re traveling.

Is the Currensea card contactless?

Yes, the Currensea card is contactless. You can use it to make payments quickly and easily without having to enter your PIN.

What fees does Currensea charge per transaction?

Currensea charges a flat fee of £0.50 per ATM withdrawal and bank fees of £0.50 per in-person transaction. There are no additional fees for foreign exchange transactions.

Does Currensea work well for international travel?

Yes, Currensea works very well for international travel. The card offers the best exchange rates and eliminates transaction fees while you’re abroad. It also links directly to your everyday bank account, making it easy to manage your finances while you’re on the go.

What are customers saying about Currensea’s customer service on Trustpilot?

Customers on Trustpilot have given Currensea a rating of 4.7 out of 5 stars. They have praised Currensea for its excellent customer service and ease of use. Many customers have also mentioned that the card works very well for international travel and offers the best exchange rates.