Freetrade Review: Is it any good?

When searching for an investment app nowadays, it can feel overwhelming. There are so many to choose from. All platforms are shiny and have cool features but determining which one to use can feel exhausting.

Now, a couple years ago when I opened a trading account, shortly after I came across, Freetrade. They have been around for some time now, they are a UK-based fintech startup designed to make investing accessible to everyone (kind of like the Robinhood app in America). The Freetrade app allows users to buy and sell shares in UK and US markets and a range of exchange-traded funds (ETFs) and investment trusts without paying any commission fees. In this review, I will share as much information as possible, to give you enough data to make a reasonable assessment to determine if the investment platform is right for you.

Key Takeaways

- Freetrade is a UK-based fintech startup that offers a commission-free trading app designed to make investing accessible to everyone.

- The platform offers a range of investment options, including UK and US stocks, ETFs, and investment trusts.

- Freetrade Plus provides additional features and benefits for a monthly fee, while the platform’s educational resources and customer support are also noteworthy.

Freetrade Overview

First things first, I find the platform really easy to use. You do not need to be tech-savvy at all. Freetrade is user-friendly and the layout makes it easy to navigate. Although it is a mobile-only stockbroker application, it has everything you need to allow you to easily buy and sell shares. It offers a wide range of stocks from the UK and US markets, covering over 1,600. The application provides access to popular shares, listed on the FTSE 100, FTSE 350, AIM, and smaller markets like Apple, Amazon, Tesla and other popular stocks like Nvidia.

The Freetrade App is available for both iOS and Android devices, making it accessible to a wide range of users. The app is intuitive and easy to navigate, making it an ideal choice for novice investors. It also offers a range of research tools, including real-time stock prices, financial news, and company data.

Freetrade’s platform is regulated by the Financial Conduct Authority in the UK, providing users with peace of mind that their investments are safe. The platform also offers investor protection of up to £85k also under the financial services compensation scheme.

One of the key advantages and the unique selling point of Freetrade is its commission-free trading, making it an affordable option for investors. It also offers fractional shares, allowing users to invest in shares that may be otherwise out of reach on other sites.

Overall, Freetrade is a reliable and user-friendly investment platform that provides users with access to a wide range of stocks and research tools. Its commission-free trading and investor protection make it an attractive option for both novice and experienced investors.

Getting Started

If you’re interested in using Freetrade, the first step is to create an account. Here’s what you need to know about account types, minimum deposit and withdrawal, and the registration process.

Account Types

Freetrade offers two types of accounts: a General Investment Account (GIA) and the Stocks and Shares ISA. The GIA is a standard investment account, while the Stocks and Shares ISA is a tax-efficient account that allows you to invest up to £20,000 per year without paying any tax on your gains (please note that this is subject to change yearly, when the UK Budget is released around April each year.

Freetrade also offers a Self-Invested Personal Pension (SIPP) for those who want to save for retirement. With a SIPP, you can invest in stocks, shares, and funds and receive tax relief on your contributions.

Minimum Deposit and Withdrawal

Freetrade has no minimum deposit requirement, which means you can start investing with as little as £1.

Freetrade also has no withdrawal fees, which means you can withdraw your money at any time without incurring any charges.

Registration Process

To register for Freetrade, first, you need to download the app from the App Store or Google Play Store. Once you’ve downloaded the app, you’ll need to provide some basic information, including your name, address, and date of birth.

You’ll also need to provide some identification, such as a passport or driver’s license, to verify your identity. Once your account has been reviewed and approved, you’ll be able to start investing.

Investment Options

Freetrade offers its users a range of investment options, including stocks, ETFs, bonds, and options. The platform allows users to invest in US and UK stocks and NASDAQ, NYSE, LSE, and AIM-listed companies.

Stocks and ETFs

Freetrade offers a wide range of stocks and ETFs to invest in. Users can browse through the app’s curated lists of stocks organized by industry or search for specific companies or ETFs. The platform offers commission-free trading on all US and UK stocks and ETFs, meaning users can buy and sell shares without incurring transaction fees.

Bonds

Freetrade also allows users to invest in bonds. The platform offers a selection of UK government bonds and corporate bonds from a range of companies. Users can invest in bonds through the app’s general investment account, which has no platform fees or charges for trading UK investments.

Options

Freetrade also offers options trading for its users. Options allow investors to speculate on the future price of an underlying asset, such as a stock or an index. The platform offers a range of options contracts, including calls and puts, allowing investors to profit from rising and falling prices.

In summary, Freetrade offers its users a range of investment options, including stocks, ETFs, bonds, and options. The platform allows users to invest in US and UK stocks and NASDAQ, NYSE, LSE, and AIM-listed companies. Users can invest in bonds through the app’s general investment account, which has no platform fees or charges for trading UK investments. Finally, Freetrade offers options trading for its users, allowing investors to speculate on the future price of an underlying asset.

Freetrade Plus

Freetrade Plus is a subscription plan offered by Freetrade that provides additional benefits to users. In this section, we will discuss the features of the Plus plan.

Subscription Plan

The Freetrade Plus subscription plan costs £9.99 per month and offers users several benefits, including:

- Instant orders: Freetrade Plus users can place instant orders, which means they can buy or sell shares at the current market price without having to wait for the order to be executed.

- Extended trading hours: Freetrade Plus users can trade during extended hours, which means they can buy or sell shares outside of the regular market hours.

- ISA transfers: Freetrade Plus users can transfer their existing ISA to Freetrade without any fees.

- Multiple accounts: Freetrade Plus users can have multiple accounts, including ISAs and general investment accounts.

Additional Benefits

In addition to the benefits mentioned above, Freetrade Plus users also get access to several other features, including:

- Advanced order types: Freetrade Plus users can use advanced order types such as stop-loss orders and limit orders.

- Price alerts: Freetrade Plus users can set price alerts for stocks they are interested in, which will notify them when the stock reaches a certain price.

- Research: Freetrade Plus users get access to premium research reports and insights from Morningstar, which can help them make more informed investment decisions.

- Larger stock universe: Freetrade Plus users can access a larger universe of stocks, including AIM-listed stocks and US stocks.

Overall, Freetrade Plus offers several benefits to users who are looking for more advanced features and functionality. The subscription plan is reasonably priced, and the additional benefits can help users make more informed investment decisions.

Trading Experience

User Interface

I really like the dashboard. It provides a clear overview of the user’s investments, including a portfolio breakdown, performance charts, and recent activity. The platform also offers a search function allowing users to quickly find specific stocks and ETFs.

The platform’s color scheme is pink and white, which might not be to everyone’s taste. However, the design is modern and visually appealing, with clear fonts and icons. The platform is also customizable, allowing users to rearrange the dashboard to suit their personal circumstances and preferences.

The mobile app offers a smooth and intuitive trading experience. Users can buy and sell shares, view their portfolios, and monitor market movements from their smartphones.

The app’s interface is similar to the desktop version, with a few minor differences to accommodate the smaller screen size. The app is responsive and fast, making it easy to execute trades quickly. The app also provides full control over push notifications for price alerts and other important events.

Fees and Charges

Freetrade is known for its commission-free trading, which means that it does not charge any fees for buying or selling stocks and ETFs. However, there are a few fees that investors need to be aware of:

Commission-Free Trading

Freetrade offers commission-free trading for stocks and ETFs. This means that investors can buy and sell shares without paying any fees. This is a significant advantage for investors who are looking to keep their costs low.

Currency Conversion Fee

Freetrade charges a currency conversion fee of 0.45% for trades in foreign currencies. This fee is applied to the value of the trade and is charged in addition to any various other charges or fees that may apply. The currency conversion fee is relatively low compared to other brokers, but investors should still be aware of this fee when trading in foreign currencies.

Inactivity Fee

Freetrade does not charge any inactivity fees. This means that investors can keep their accounts open without having to worry about being charged for not trading. However, Freetrade does charge a monthly fee of £3 for ISA accounts and a premium service called Alpha is in the works, which will reportedly cost £10 per month.

Customer Support

Freetrade provides customer support through live chat and phone support. They do not offer email support, but users can submit a request through the app or website.

Freetrade’s live chat support is available from 8 AM to 9 PM on weekdays and from 9 AM to 4 PM on weekends. Users can access live chat by clicking on the chat icon in the app or website. The live chat support team is knowledgeable and responds promptly to user inquiries.

Phone Support

Freetrade’s phone support is available from 8 AM to 9 PM on weekdays and from 9 AM to 4 PM on weekends. Users can call the support team at +44 20 3917 1000. The phone support team is also knowledgeable and can assist users with any questions they may have.

Overall, Freetrade’s customer support is reliable and responsive. Users can expect prompt and helpful assistance through live chat and phone support.

Security and Regulation

Freetrade is regulated by the Financial Conduct Authority (FCA) and is authorized and regulated by the FCA under firm reference number 783189. The FCA is a regulatory body in the UK that oversees financial markets and firms to ensure that they operate in a fair and transparent manner and protect consumers.

Freetrade is a member of the Financial Services Compensation Scheme (FSCS), which provides protection to consumers if a firm becomes insolvent or ceases trading. The FSCS provides protection up to £85,000 per person, per firm. This means that if Freetrade were to become insolvent, customers would be protected up to £85,000.

They take security seriously and uses industry-standard encryption to protect customer data. They also use two-factor authentication to ensure that only authorized users can access their accounts. Additionally, Freetrade has a risk management team that monitors the platform for any suspicious activity and takes appropriate action if necessary.

Educational Resources

Freetrade offers a range of educational resources to help users become more knowledgeable about investing. These resources are available to all users, regardless of their level of experience.

Guides

Another cool feature we like about the brand is its range of guides available on its website and YouTube covering topics such as investing in stocks and shares, building a diversified portfolio, and using the Freetrade app. These guides are written in a clear and concise manner, making them easy to understand even for beginners.

Investment Education

Freetrade also offers a range of investment education resources, including a blog and a podcast. The blog covers a range of topics related to investing, including market news, investment strategies, and company analysis. The podcast features interviews with industry experts and covers a range of topics related to investing.

Freetrade also offers a range of research tools to help users make informed investment decisions. These tools include market data, company profiles, and analyst ratings.

Overall, Freetrade’s educational resources are comprehensive and easy to use. Whether you are a beginner or an experienced investor, there is something for everyone.

Conclusion

One of the standout features of Freetrade we like is its diversified portfolio and commission-free trading, which is designed to minimize risk and maximize returns. The app offers a range of investment options, from individual stocks to pre-built portfolios, making it easy for users to create a diversified portfolio that suits their needs.

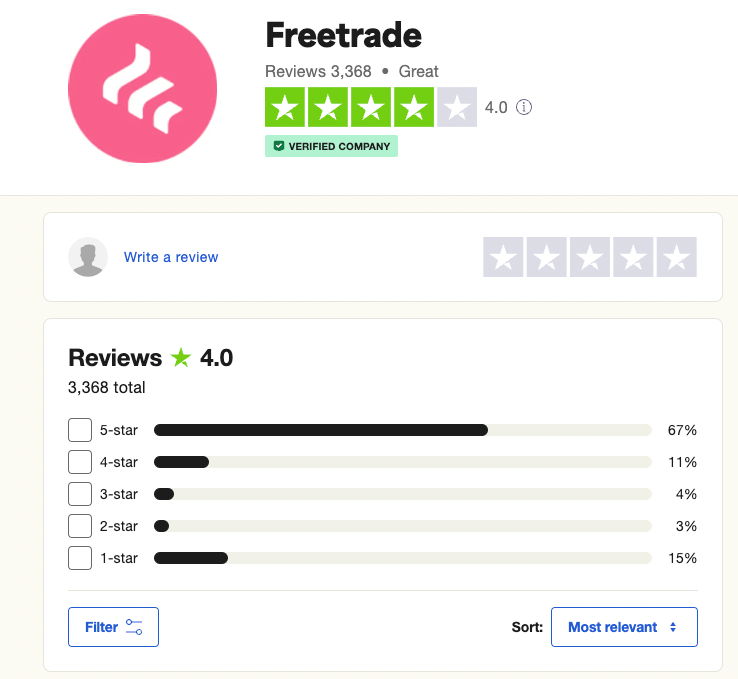

In terms of performance, Freetrade has received positive reviews from customers, with many praising its user-friendly interface and low fees. See the Freetrade Trustpilot reviews.

Overall, Freetrade is an excellent choice for investors who are looking for a commission-free trading app that is easy to use and offers a diversified portfolio. With its low fees and user-friendly interface, it is a great option for novice investors just starting out in the investing world.

Frequently Asked Questions

Is Freetrade a safe investment platform?

Freetrade is a regulated investment platform that is authorized and regulated by the Financial Conduct Authority (FCA) in the UK. In our opinion, the platform is safe and during our research, we didn’t find many negative customer reviews scrutinizing the security of the platform.

What are the fees associated with using Freetrade?

Freetrade offers commission-free trading for UK and US stocks, ETFs, and funds. However, there are some fees that investors should be aware of, such as foreign exchange fees, stamp duty, and a £3 fee for instant trades. Freetrade also offers a premium subscription service, which includes additional features and benefits for a monthly fee.

How does Freetrade make money?

Freetrade makes money through a variety of revenue streams, including interest on cash balances, foreign exchange fees, and its premium subscription service. Freetrade also earns revenue from securities lending, which involves lending out shares held by investors to other capital market participants in exchange for a fee.

What are the differences between Freetrade and Trading 212?

Freetrade and Trading 212 are commission-free investment platforms offering a range of investment products. However, there are some key differences between the two platforms. For example, Freetrade offers a wider range of investment products, including funds and ETFs, while Trading 212 focuses mainly on stocks. Freetrade also offers a premium subscription service, while Trading 212 does not.