Meme Investing: A Genius Strategy or a Gamble

After an emotional rollercoaster in 2021, meme stocks have been skyrocketing yearly with different ‘meme stocks’ and ‘meme coins’ booming! Retail investors and so-called ‘Reddit traders’ are banking huge profits from companies like AMC Entertainment, GameStop, and Cryptocurrencies like Dogecoin and Pepe Coin.

This ongoing saga began in January 2021 when activist investors backed struggling companies like GameStop and BlackBerry in a bid to hurt short sellers. The outcome led top Wall Street traders to suffer, and investors into these companies with sizeable profits which makes you question, is it still worth investing in a S&P 500 Index Fund which has returned roughly 10% annually over long periods?

As a millennial investor myself, the thought of investing monthly and receiving a measly 10% return on average over 20-30 years and allowing compound interest to work in your favour doesn’t look as great as it used to when I speak to my friends on WhatsApp groups and see GameStop, Dogecoin and AMC producing six figure returns and millionaires overnight. So, it begs the question, should ‘meme investing be a strategy incorporated into my investment portfolio, or should you avoid these stocks and cryptocurrencies like the plague and categorise it as pure gambling? Let’s take a deeper look.

Background

GameStop, a business which has both brick-and-mortar stores, and an online e-commerce shop has been in financial problems ever since the height of the pandemic. With Wall Street traders being aware of the companies cash flow position, a bunch of traders bet that GameStop will fail and share prices will consequently crumble – known as ‘shorting’. While these positions were taking place, a group of redditors in a thread called WallStreetBets bought millions worth of GameStop shares in order to force professional investors and hedge fund to get out of their bets, and this eventually worked by retail investors in the US flocking to apps like Robinhood and UK investors buying shares on Trading 212.

This gave birth to the terminology ‘meme investing’ and other stocks and crypto (more on crypto later) like AMC, Blackberry and struggling brick and mortar ‘Bed Bath & Beyond’ rallying in price in short spaces of time.

The Numbers & Statistics

While reading this blog post, please remember that the information is time sensitive and the performance below is based on the returns as of June 2021. Disclaimer: Please remember that past performance may not be indicative of future results. Meme and cryptocurrency investing involves a varying degree of risk and should be approached with caution.

- AMC Entertainment (Stock) year to date performance is 3000%

- GameStop (Stock) year to date performance is 1,430%

- Dogecoin (Crypto) year to date performance is 6000%

Now of course, these returns are not typical but let’s be honest, they do make you question your investing strategy. I know for myself, when I discovered there was a Dogecoin millionaire and a flight attendant who became a millionaire with GameStop in his holdings it made my modest returns of 10-20% a year (which I thought was good by the way) look diabolic and shameful. I really started to think, is Meme investing here to stay?

With billionaires like Mark Cuban changing their narratives from being cautious of cryptocurrencies to now holding digital assets and tweeting “if I had to choose between buying a lottery ticket and Dogecoin…I would rather buy Dogecoin” with the odds of lottery tickets for the Mega Millions jackpot being like 1 in nearly 300 million I think it’s a better option investing in Dogecoin and Meme Stocks, a strategy of which I support especially with the era of investing boasted by Reddit, Telegram, TikTok, Twitter and WhatsApp groups encouraging more Millennial & Gen Z investors to make gains by investing in these speculative and high risks stocks and cryptos.

Taking Calculated Risk

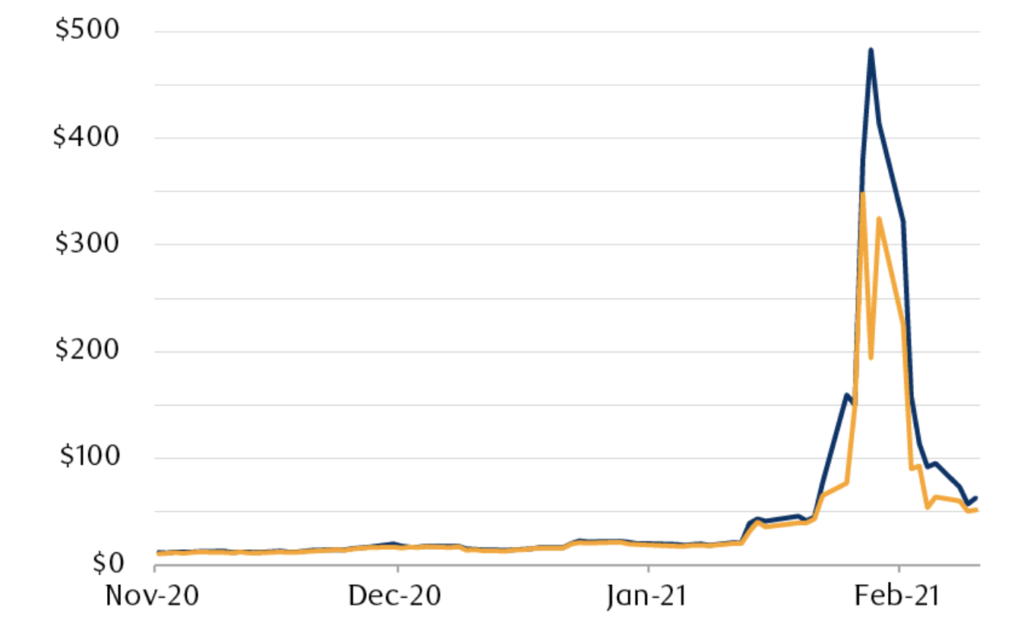

If we take a closer look at GameStop as an example, shares are currently trading at $257 (as of 3rd June 2021), reached to a high of $483 in late January but was floating between $40 – 100 in February 2021 when they first came to my attention. Now I don’t know about you, but those swings are not for the faint hearted. Where there are pumps and short squeezes you need to be made aware in real time, know when to ‘Hodl’ and be ready to pull the trigger at the right time while markets are open, or you will face big losses to say the least.

The massive surges in price are dramatic and if you are new to stock picking, I think it’s fair to say if you are considering investing in a meme stock to approach with caution. Before entering a position, the best way to mitigate your risk and take a calculated approach is to join in on the digital chats and other tools used to form a meme stock strategy because entering at the wrong time could be costly. Take a look below of the AMC and GameStop short squeezes over the past few months…

GameStop Corp. (NYSE: GME)

AMC Entertainment Holdings Inc (NYSE: AMC)

Conclusion – Genius Strategy or Gambling?

Although it’s unclear how long this phase of social media frenzy to pump stocks will last, traditional investing in long term portfolios of dividend, value and growth stocks is unlikely to have a major impact to seasoned investors. The safety net of steady returns which compound over time still have an appeal and quite frankly allow you to sleep at night not thinking whether or not your stop loss and take profit positions are set up correctly, coupled with anxiety of the potential losses you can take in a short space of time.

The volatility of meme investing is not for everybody and although I personally believe the phenomenon will continue to accelerate due to broader digitisation and the sharing of data across social media platforms, for the savvy investor only a small percentage of funds should be allocated to these meme stocks while focusing on traditional strategies such as maximising your Roth Individual Retirement Accounts (IRA’s) , 401(K) for US residents or your Stocks and Shares ISA and Employers Pension Contribution pot for UK residents.

Thank you for putting together this easy to read content Dom and the team over at the Ambitious Investor HQ. You all have helped me improve my credit score and your stories have encouraged me to launch my own blog. Keep up the weekly content, it is needed 🙂