St James Place Pension: Everything You Need to Know

St James’s Place Pension is a popular pension scheme in the UK that offers a range of investment options to help individuals build their retirement savings. The scheme is designed to provide a flexible and tax-efficient way to save for retirement, with a range of investment options available to suit different risk appetites and investment goals.

St James’s Place Pension is known for its strong performance record, with many investors seeing strong returns on their investments over the long term. The scheme is managed by a team of experienced investment professionals who have a deep understanding of the markets and are able to identify opportunities for growth and value. With a focus on long-term investment strategies, St James’s Place Pension is a popular choice for those looking to build a secure retirement income and have a detailed financial plan for their future.

Overall, St James’s Place Pension is a reliable and reputable pension scheme that offers a range of investment options to help individuals build their retirement savings. With a strong performance record and a focus on long-term investment strategies, it is a popular choice for those looking to secure their financial future in retirement.

Understanding St James Place Pension

History

St James Place Pension is a pension scheme offered by St James’s Place Wealth Management, a UK-based company that provides financial planning services to support their customer’s financial well-being. The company was founded in 1991 and is headquartered in Cirencester, Gloucestershire. It is listed on the London Stock Exchange and is a member of the FTSE 100 index.

St James’s Place Wealth Management offers a range of financial products and services, including investments, pensions, and life insurance. The St James Place Pension is one of the company’s flagship products and is designed to provide individuals with a flexible and tax-efficient way to save for their retirement.

Key Features

The St James Place Pension offers a number of key features that make it an attractive option for individuals looking to save for their retirement. These include:

- Tax-efficient savings: Contributions to the St James Place Pension are eligible for tax relief at the individual’s marginal rate of income tax, up to certain limits. This means that individuals can save for their retirement while also reducing their tax bills.

- Flexible contributions: The St James Place Pension allows individuals to make contributions on a regular or ad-hoc basis, depending on their needs and circumstances. There are no minimum or maximum contribution levels, giving individuals the flexibility to save as much or as little as they want.

- Investment choice: The St James Place Pension offers a wide range of investment options, including funds managed by some of the world’s leading investment managers. This allows individuals to tailor their pension portfolio to their specific investment goals and risk appetite.

- Retirement options: When it comes to retirement, individuals can choose from a range of options, including taking a tax-free lump sum, purchasing an annuity, or entering into income drawdown.

Overall, the St James Place Pension is a flexible and tax-efficient way for individuals to save for their retirement. With a wide range of investment options and retirement choices, it is designed to meet the needs and life goals of a range of investors, from those just starting out to those approaching retirement.

Benefits of St James Place Pension

St James’s Place Pension offers a range of benefits to its members, including:

- Flexible Contributions: Members can choose to contribute as little or as much as they want, with the option to increase, decrease, or pause contributions at any time.

- Tax Relief: Contributions to St James Place Pension are eligible for tax relief, meaning members can receive up to 45% tax relief on their contributions.

- Investment Options: St James Place Pension offers a range of investment options to suit different risk appetites and investment goals, including ethical and socially responsible investment options.

- Lump Sum Options: Members can choose to take up to 25% of their pension pot as a tax-free lump sum when they reach retirement age.

- Death Benefits: In the event of a member’s death, their beneficiaries will receive a lump sum payment or regular income payments, depending on the member’s individual circumstances.

- Professional Management: St James Place Pension is managed by a team of experienced investment professionals, who work to maximise returns while managing risk.

Overall, St James Place Pension provides a flexible and tax-efficient way for members to save for retirement, with a range of investment options and benefits to suit each family with different needs and circumstances.

Investment Options

St James Place Pension offers a variety of investment options to suit different investment objectives and risk tolerances. The investment options available include:

St James’s Place Unit Trusts

St James’s Place Unit Trusts are managed by a team of experienced investment professionals who aim to deliver consistent returns over the long term. The unit trusts cover a range of asset classes, including equities, fixed income, property, and alternatives.

St James’s Place Investment Trusts

St James’s Place Investment Trusts are managed by external fund managers who are selected based on their investment expertise and track record. The investment trusts cover a range of sectors, including UK equities, global equities, and property.

St James’s Place Multi-Asset Funds

St James’s Place Multi-Asset Funds are designed to provide investors with a diversified portfolio of assets. The funds are managed by a team of experienced investment professionals who aim to deliver consistent returns over the long term. The multi-asset funds cover a range of risk profiles, from cautious to adventurous.

St James’s Place Discretionary Fund Management Service

St James’s Place Discretionary Fund Management Service is designed for investors who prefer a more personalised investment approach. The service is provided by St James’s Place Wealth Management’s team of investment professionals, who manage portfolios on behalf of clients based on their individual investment objectives and risk tolerances.

Investors can choose to invest in one or more of these investment options, depending on their investment objectives and risk tolerances. St James Place Pension provides investors with access to a range of investment options, which can be tailored to meet their individual needs.

Charges and Fees

St James Place Pension offers a range of investment options that come with different charges and fees. It is important to understand these charges and fees before making any investment decisions.

Annual Management Charge

The Annual Management Charge (AMC) is the fee charged by St James Place Pension for managing the investment. The AMC varies depending on the investment option chosen. For example, the AMC for the St James Place Equity Income Fund is 1.6%, while the AMC for the St James Place Managed Growth Fund is 1.25%.

Other Charges

In addition to the AMC, there are other charges that investors should be aware of. These include:

- Fund Charges: These are charges levied by the fund manager for managing the fund. The charges vary depending on the fund and are typically included in the AMC.

- Initial Charge: This is a one-time charge levied when an investor makes an initial investment. The charge varies depending on the investment option chosen.

- Exit Charge: This is a charge levied when an investor exits the investment. The charge varies depending on the investment option chosen and the length of time the investment has been held.

Transparency

St James Place Pension is committed to transparency and ensures that all charges and fees are clearly stated. Investors can find detailed information about charges and fees on the St James Place Pension website or by speaking to a financial adviser.

Overall, while charges and fees are an important consideration when investing, it is also important to consider the potential returns and the overall suitability of financial plan as the investment option for an individual’s needs and goals.

Accessing Pension

Accessing your St James Place Pension is a straightforward process. Once you reach age 55, you can start accessing your pension pot. There are several options available to you, and you can choose the one that best suits your requirements.

Taking a Cash Lump Sum

You can take a cash lump sum of up to 25% of your pension pot tax-free. The remaining 75% can be used to provide you with a regular income.

Annuity

An annuity is a financial product that provides you with a guaranteed income for life. You can use your pension pot to purchase an annuity from an insurance company. The amount of income you receive will depend on the size of your pension pot, your age, and your health.

Drawdown

With drawdown, you can keep your pension pot invested and withdraw money from it as and when you need it. You can take up to 25% of your pension pot tax-free, and the remaining 75% will be subject to income tax. It is essential to keep in mind that the value of your pension pot can go up or down, and you may run out of money if you withdraw too much too quickly.

Combination of Options

You can also combine the above options to suit your needs. For example, you could take a cash lump sum and use the remaining money to purchase an annuity or put it into drawdown.

It is essential to seek professional advice from financial advisers before making any decisions about accessing your pension. A financial advisor can help you understand your options and make informed decisions that are right for you.

St James Place Pension vs Other Pensions

St James Place Pension is a popular pension scheme in the UK, but how does it compare to other pensions on the market? In this section, we will compare St James Place Pension to other pensions in terms of fees, investment options, and customer service.

Fees

St James Place Pension is known for its high fees, which can be a concern for some investors. In comparison, other pension schemes such as Hargreaves Lansdown and AJ Bell Youinvest offer lower fees and more transparent pricing structures. However, it’s worth noting that St James Place Pension offers a wide range of investment options, including some that may not be available with other pensions.

Investment Options

One of the advantages of St James Place Pension is its diverse range of investment options. The scheme offers access to a wide range of funds, including actively managed funds and passive funds, as well as alternative investments such as property and private equity. In comparison, other pension schemes may have more limited investment options, particularly when it comes to alternative investments.

Customer Service

St James Place Pension has a reputation for providing excellent customer service. The scheme offers a personal, financial planning advice service, which can be beneficial for those who need help with retirement planning. However, other pension schemes such as Hargreaves Lansdown and AJ Bell Youinvest also offer a range of customer service options, including online chat, phone support, and face-to-face meetings.

Overall, St James Place Pension has its advantages and disadvantages when compared to other pension schemes. While its fees may be higher than some other options, it offers a wide range of investment options and excellent customer service. Investors should carefully consider their needs and preferences when choosing a pension scheme.

Potential Risks

When considering investing in the St James Place Pension, it is important to be aware of the potential risks involved detailed financial retirement plan. While the pension plan can offer many benefits, there are also some risks that investors should be aware of.

One of the main risks is the possibility of investment losses. As with any investment, there is no guarantee of returns, and the value of investments can go down as well as up. This means that investors could potentially lose money if the investments in the pension plan perform poorly.

Another risk is the possibility of inflation eroding the value of the pension. While the pension plan is designed to provide a steady income in retirement, if inflation rates rise significantly, the value of the pension could be reduced in real terms.

There is also the risk of changes to tax laws and regulations. The tax treatment of pensions can change, which could affect the amount of tax relief available on contributions, or the amount of tax payable on withdrawals.

Finally, there is the risk of the pension provider becoming insolvent. While St James Place is a well-established and reputable company, there is always a risk that it could run into financial difficulties in the future. In this scenario funds under management only, investors may not receive the full value of their pension.

Overall, while the St James Place Pension can offer many benefits, it is important to be aware of the potential risks involved and to carefully consider these before making any investment decisions.

How to Start a St James Place Pension

Starting a St James Place Pension is a straightforward process. Here are the steps to follow:

- Find a Financial Adviser: The first step to starting a St James Place Pension is to find a financial adviser who is authorized to sell St James Place products. The adviser will help you understand your options and guide you through the process.

- Choose Your Investment Options: Once you have found a financial adviser, you will need to decide on your investment options. St James Place offers a range of investment options, including funds managed by St James Place and external managers. Your financial adviser will help you choose the right investment options based on your goals and risk tolerance.

- Complete the Application: After you have chosen your investment options, your financial adviser will help you complete the application process. You will need to provide personal information, including your name, address, and date of birth, as well as information about your employment and income.

- Make Your First Contribution: Once your application has been approved, you can make your first contribution to your St James Place Pension. You can make regular contributions or a lump sum payment, depending on your preference.

- Monitor Your Investment: It is important to monitor your investment regularly to ensure that it is performing as expected. Your financial adviser will help you monitor your investment and make any necessary adjustments.

Starting a St James Place Pension is a great way to save for your retirement. With the help of a financial adviser, you can choose the right investment options and make regular contributions to build your retirement savings.

St. James’s Place customer reviews

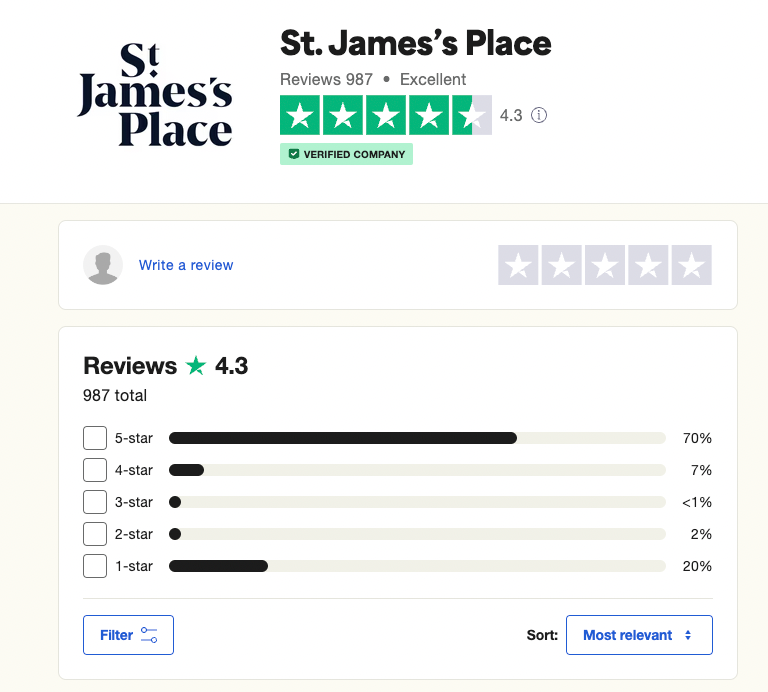

The reviews on TrustPilot suggest that St.James Place is an Excellent company. Based on my experience for 6 months being a customer, prior to moving to another firm, I would also agree. For every notification, I was informed by letter in the post and I also had the opportunity to book a call with a financial advisor whenever I wanted to over a Zoom call.

The firm focuses on building relationships with their customers and this is a testament to their reviews being 4.3 out of 5 on average across Trustpilot.

Conclusion

St James Place Pension is a flexible and comprehensive pension scheme that offers a range of investment options to suit different risk appetites. The scheme provides a reliable and secure way for individuals to save for their retirement, with the added benefit of tax relief on contributions.

One of the key advantages of St James Place Pension is the ability to choose from a wide range of investment funds, including actively managed funds and passive funds. This allows investors to tailor their portfolios to their individual preferences and risk appetite.

Another advantage of St James Place Pension is the flexibility it offers in terms of contributions. Investors can choose to make regular contributions or make lump sum contributions as and when they are able to. This flexibility means that investors can adjust their contributions to suit their changing financial circumstances.

St James Place Pension also offers a range of additional features, such as the ability to transfer in existing pension plans, and the option to take tax-free cash at retirement. The scheme also provides access to financial advice and planning services, which can be invaluable in helping individuals to make informed investment decisions.

Overall, St James Place Pension is a reliable and flexible pension scheme that offers a range of benefits to investors. With a wide range of investment options, flexible contribution options, and additional features such as financial advice and planning services, St James Place Pension is a strong option for individuals looking to save for their retirement.

Another pension provider which has become one of our favorites is Pension Bee. Let us know what you think in the comment section on what you currently use to manage your pension or what service provider you plan to go with.