What is the Average Pension Pot in UK?

What is the average pension pot in the UK?

Let’s get straight to the point, shall we…

The current 2023 average pension pot in the UK is £30,000 for those aged between 35-44. This is nowhere near what most elders need to retire comfortably.

I can confidently say that you need a pension wealth pot ideally in the region of £55,000 per year to live comfortably and enjoy your retirement. Before writing this blog, I spoke to my Uncle Lloyd who was a Mechanic and also worked for the Local Council and receives a pension and he told me, “You need £2,000 a month nephew, even if you have adult children”.

In this blog, we will share with you the recommendations you should aim for by age band, to give yourself an annual net income sufficient enough for you to live comfortably.

Before we dive into the numbers, check out our blog on PensionBee, a reputable pension provider we use, and one which has low fees, is user-friendly, and has a great track record for growing pensions over time.

What does a good pension pot look like?

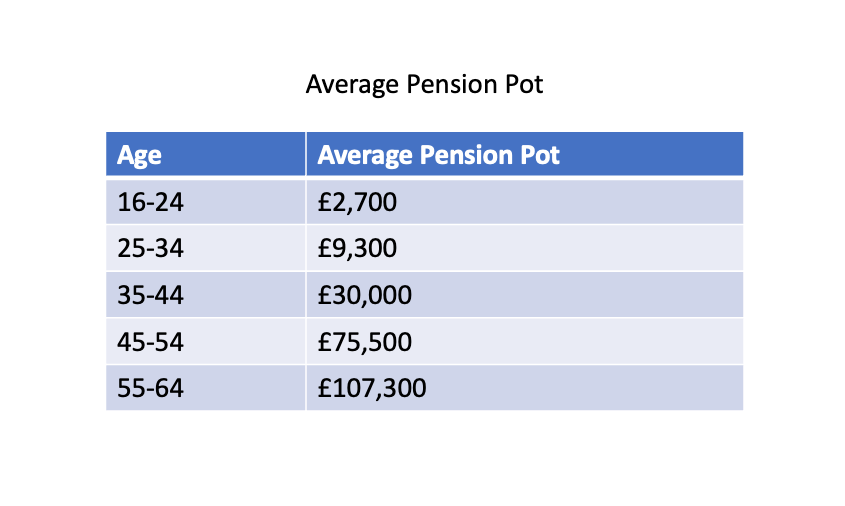

According to ONS data, here is the UK citizen average UK, average pensioner per pot based on age banding.

This is nowhere near enough. A good pension pot is usually a substantial sum of money saved up over the course of your working life that provides financial security and stability during your retirement years. If you retire at 65 years old and only have £107,300 to survive off and live until 90 – quite simply, you just won’t have enough as this equates to around £4,292 a year.

The size of a good pension pot will depend on various factors, including your desired retirement lifestyle, expected life span, and any additional sources of income pension savings you may have but the goal of old pension pots should be to have more than just enough to get by. As we get older, we must also think about health and how much we need to save for unforeseen medical bills too.

How to save for retirement in the UK?

Saving for retirement in the UK is essential to ensure financial security during your later years. There are several retirement savings options and strategies available. Here’s a step-by-step guide on how to save for retirement in the UK:

Start Saving From Your First Employment

The earlier you start saving for retirement, the more time your money has to grow through compound interest. Even small contributions made fund retirement very early on can make a significant difference in the long run.

Understand Your Workplace Pension

Check if your employer offers a workplace pension scheme. If they do, you will likely be automatically enrolled, and they may also match your contributions up to a certain percentage of your salary. Take full advantage of this, as it’s essentially free money.

Personal Pension Plans

Consider setting up a personal pension plan, such as a Self-Invested Personal Pension (SIPP) or a Stakeholder Pension. These are private pension schemes that you can contribute to independently of your workplace pension.

Contribute Regularly and Consistently

Contribute to your pension funds regularly. You can set up direct debits or standing orders to make monthly or annual contributions, making it easier to stay on track.

Lifetime ISA (LISA)

If you’re under 40, consider opening a Lifetime ISA. It allows you to save up to £4,000 per year, and the government provides a 25% bonus on your contributions, up to a maximum of £1,000 per year.

ISA Accounts

Use Individual Savings Accounts (ISAs) for additional tax-efficient savings. There are different types of ISAs, such as Cash ISAs and Stocks & Shares ISAs, which can help you grow your savings without paying tax on the interest or investment returns.

Diversify Your Investments

If you have a SIPP or other investment-based pension, consider diversifying your investments across different asset classes to spread risk and potentially achieve higher returns.

Monitor and Adjust

Regularly review your pension performance and adjust your contributions and investment strategy as needed. As you approach retirement age, consider reducing risk to protect your savings.

Consider a Financial Advisor

Seek advice from a qualified financial advisor who can help you create a personalized retirement plan based on your goals and financial situation.

Consolidate Old Pensions

If you have multiple workplace pensions from previous jobs, consider consolidating them into a single pension account to better manage and track your retirement savings.

Remember that retirement planning is a long-term commitment. Regularly reassess your financial situation and your retirement plans and goals to make sure you’re on track to achieve a comfortable retirement. The UK government also provides various resources and information on retirement planning and tax free and through the gov.uk website, so be sure to check those out for additional guidance.

Average UK retirement income

The average retirement income in the UK can vary widely depending on various factors such as the type of pension, individual savings, and other sources of income. It’s important to note that the annual retirement income figures can change over time due to economic factors, inflation, and changes in pension regulations.

As of March 2023, the average UK retirement income was estimated to be around £18,772 per year or £1,564 per month. However, this figure includes pension contributions from both state pension benefits and private pension income.

The State Pension is a defined benefit, a government-provided pension that all eligible individuals in the UK can receive. As of September 2021, the full State Pension was £179.60 per week, which would amount to a pension fund of approximately £9,339 per year.

On top of the State Pension, many people also have private or workplace pensions, personal savings, and investments that contribute to a significant impact on their retirement income. These additional sources of guaranteed income can significantly increase the overall retirement income for individuals who have been proactive in saving for retirement.

Keep in mind that these monthly income figures are approximate averages, and actual retirement incomes can vary widely based on individual circumstances. Factors such as the size of the pension pot, other sources of income, lifestyle choices, and investment performance can all impact an individual’s retirement income. Additionally, changes to pension regulations or the economy may affect retirement income levels in the future.

For the most up-to-date and accurate information on the average retirement income in the UK, it’s best to refer to official government sources or consult with financial experts who can provide personalized investment advice, based on your specific situation.

What is a good pension pot at 65?

A “good” pension at 65 is a subjective term that can vary depending on an individual’s lifestyle, financial goals, and other sources of retirement and other income elsewhere. It’s essential to consider various factors before reaching retirement age when determining what constitutes a good pension for your retirement. Here are some key considerations:

- Income Replacement: A good pension should ideally replace a significant portion of your pre-retirement income. Financial advisors often recommend aiming for a retirement income that is around 70% to 80% of your pre-retirement income to maintain a similar standard of living.

- Basic Living Expenses: Your pension should be sufficient to cover your essential living expenses, such as housing, utilities, food, healthcare, and transportation.

- Desired Retirement Lifestyle: Consider the lifestyle you want to lead during retirement. If you plan to travel, pursue hobbies, or engage in activities that require additional funds, a good pension should be able to support these aspirations.

- Healthcare Costs: Healthcare expenses tend to increase with age, so a good pension should provide some cushion to cover potential medical costs.

- Additional Retirement Savings: In addition to your pension, having other sources of retirement savings, such as personal savings, investments, or property, can enhance your overall financial security during retirement.

Ultimately, the definition of a good pension will vary from person to person and also depends on individual circumstances. My personal target and one which I view as comfortable is around £38,000- 40,000/per year. This would cover all the basics and allow me to have luxuries too. For some, this may be sufficient and for some this may not even be enough money. If you are not sure and need to see what works best for you, I would remind you to check out PensionBeee, a really good service that can guide you on what is the adequate figure based on your lifestyle.

What is the State Pension?

The state pension is a regular payment provided by the government to eligible individuals in the United Kingdom as a form of retirement income. It is designed to offer a basic level of financial support to individuals after they reach their state pension age.

The state pension in the UK consists of two main components:

Basic State Pension

This is a flat-rate pension amount that is available to individuals who have reached their state pension age and have made sufficient National Insurance contributions during their working life. The amount of the basic state pension is set by the government and is subject to change each year.

New State Pension (or State Pension for those who reached pension age after April 6, 2016)

The new state pension replaced the previous basic state pension and additional state pension (also known as the State Second Pension or SERPS). To qualify for the new state pension, individuals need to have a minimum number of qualifying years of National Insurance contributions. The exact number of qualifying years required to receive the full new state pension varies depending on your circumstances.

The state pension age has been gradually increasing in the UK due to changes in legislation. It is essential to check the official government website or speak with the Department for Work and Pensions (DWP) to find out how much income is the specific state pension age that applies to you.

It’s worth noting that the state pension is generally considered a foundation for retirement income, and many people rely on additional sources of income, such as workplace pensions, private pensions, and personal savings, to supplement their retirement lifestyle. The state pension amount may not be sufficient for some individuals to maintain their desired standard of living during retirement, which is why it’s essential to consider additional forms of yearly income as part of retirement planning and savings.

Average Pension Pot vs Recommended Pension Pot

The average pension pot in the UK is £107,350 for those age 65. We personally do not believe this is sufficient to live comfortably. Based on research conducted by Loughborough’s Centre for Research in Social Policy on the retirement living standards. The researches suggested that you need between £12,800 – 19,000 a year.

The research also went into detail of those who enjoy the finer things in life and for singles and couples who desire a comfortable lifestyle. This suggested a single person would need £37,300 a year or £54,500 a year as a couple. This is for the couples that enjoy those long Mediterranean and Caribbean cruises and those that may opt for Waitrose over Lidly for their weekly food shop.

To live like this, you would need a pension pot around the £747,000+ mark (plus the State Pension). If this seems like a lot, don’t worry – We go into detail on how to increase your pension pot and also discuss the pension providers we like, like Pension Bee who provide you with data to show you how much your pension pot will be upon retirement.

Types of Pensions

Private Pension

A private pension, also known as a personal pension or a personal pension plan, is a retirement savings plan that individuals can set up privately to save for their retirement. It is separate from any workplace pension scheme and is not provided by an employer. Private pensions are a way for individuals to take control of their retirement savings and build a nest egg to support them during their retirement years.

Workplace Pension

A workplace pension is a retirement savings plan provided by an employer to its employees. It is a form of occupational pension scheme designed to help employees save for their retirement years. Workplace pensions aim to ensure that employees have a source of income in addition to the state pension when they reach retirement age.

Here are some key points about workplace pensions:

- Employer Contributions: One of the main advantages of a workplace pension is that the employer typically contributes to the pension on behalf of the employee. Employers are required by law in the UK to provide a workplace pension through the automatic enrollment process.

- Employee Contributions: Employees also make contributions to their workplace pension, and these contributions are deducted from their salary before tax. The employee’s contributions are then added to the pension pot along with the employer’s contributions.

- Automatic Enrollment: Employers automatically enroll eligible employees into the workplace pension scheme. Employees have the option to opt out if they choose, but the default is to be enrolled.

- Contribution Levels: The contribution levels for workplace pensions are subject to minimum requirements set by the government. These contribution levels may vary over time, and employers and employees must meet the minimum requirements.

- Investment Options: Workplace pensions typically offer a range of investment options for employees to choose from. Employees can decide how their pension contributions are invested, with options such as stocks, bonds, and other assets.

Workplace pensions are an important component of retirement planning for many employees, and they provide a valuable benefit by helping employees build up savings for their retirement years with the added benefit of employer contributions. It is essential for employees to understand the terms of their workplace pension and take advantage of the employer’s contributions to maximize their retirement savings.

Self-invested personal pension (SIPP)

A SIPP stands for “Self-Invested Personal Pension,” and it is a type of personal pension plan available in the United Kingdom. A SIPP is a tax-efficient retirement savings vehicle that allows individuals to have more control and flexibility over their pension investments compared to traditional personal pension plans.

Here are the key features of a SIPP:

- Investment Choice: Unlike regular personal pensions, where the investment options are limited to a pre-selected range of funds, a SIPP allows the pension holder to choose from a much broader range of investment options. These options may include stocks, bonds, mutual funds, exchange-traded funds (ETFs), commercial property, and other assets.

- Control: SIPP holders have a high level of control over how their pension funds are invested. They can actively manage their investment portfolio or enlist the services of a financial advisor or investment manager to make investment decisions on their behalf.

- Tax Benefits: Similar to other pension schemes in the UK, contributions to a SIPP receive tax relief at the individual’s marginal rate. This means that for every £100 contributed to a SIPP, a basic rate taxpayer only needs to contribute £80, and the government adds £20 in tax relief, making the total contribution £100. Additional tax relief can be claimed by higher and additional rate taxpayers through their tax returns.

The Best Personal Pension Providers

We have reviewed a few pension providers and on our blog, our favorite is Pension Bee. We wrote a review on Pension Bee. Check it out here. For more independent reviews on pension providers, I would recommend you check out Unbiased to see what may be right for you and also to get another opinion.

Final Thoughts

We understand the above information may seem complicated. But as long as you remember to consistently invest into your pension pot and allow your money to grow through compound interest – you should be in a good position when retirement comes around.

We recommend and cannot stress it enough, to open up a personal pension pot, you can get started with a company like PensionBee which comes out on top being easy to use, a great track record for growing pensions and low management fees. Additionally, if you are looking for trusted advisory services, check out Moneyfarm – they have an advisory team that can help you with financial decisions for your future.

All the best with your contributions to your pension – we know for sure your future self will thank you for it!