This independent InvestEngine review examines how the platform compares with other trading platforms. We review the platform’s unique features, investment options, and whether it is really the best way to invest in ETFs. We also look at the pros and cons associated with InvestEngine, as well as other options.

InvestEngine £25: Welcome Bonus Offer

A £25 Welcome Bonus is available for a limited period to Ambitious Investor subscribers. Sign up to InvestEngine by clicking this link. Once you have invested at least £100, the bonus will be paid. Terms and conditions apply.

What is InvestEngine?

InvestEngine seems like a fascinating proposition. It was launched in 2019, and claims to be smarter, more efficient, cheaper, and more accessible than any traditional investment manager. InvestEngine, in reality, is an investment platform which aims to be a one stop shop for DIY investors.

There are two main types of investment platforms. First, there are large investment platforms like Interactive Investor* or Hargreaves Lansdown* that specialize in offering a wide variety of unit trusts, investment funds (ETFs), and share trading services that enable investors to create their own investment portfolios. These are the best investment platforms for Do-It Yourself.

There are also robo-advice websites such as Nutmeg and Moneyfarm. These services offer low-cost portfolios that can be managed at a discretionary fee, often with very low investment requirements. These services don’t allow investors to choose their own investment funds or shares. This is partly why they can keep costs low. These so-called investment managers or robo-advice platforms can make regulated portfolio recommendations based on a limited number of portfolios.

InvestEngine is a unique platform because it combines the best of both of these types of platforms. 13 low-cost, diversified managed ETF portfolios are the heart of InvestEngine. These ETF portfolios are similar to Moneyfarm and Nutmeg. InvestEngine allows investors who prefer a more hands-on approach, to choose their own investment funds.

InvestEngine can combine the managed portfolio option offered by most robo advice platforms with some of the DIY options offered by larger investment platforms like Hargreaves Lansdown. It does this at a lower price, but with fewer investment options. InvesEngine’s innovative products are a sign that it is trying to compete in a highly competitive market by innovating and not simply copying its competitors.

How does InvestEngine function?

InvestEngine allows investors to create and manage their investment portfolios or for those who prefer to have someone else make investment decisions on behalf of them, InvestEngine’s investment team can build and manage a portfolio at their discretion as shown below.

Both options are very competitively priced. The DIY portfolio option is free from any platform charges from InvestEngine, while managed portfolios have an annual fee of 0.25%. This is nearly half the cost of the most popular UK investment platform. This review will compare the costs of investing through InvestEngine to its peers.

InvestEngine’s low-cost pricing structure is undoubtedly attractive to individual investors. However, business owners can use it to invest in their businesses without having to take cash out. This feature is what sets InvestEngine apart among its competitors.

Portfolios managed by InvestEngine

InvestEngine’s portfolios can be divided into two types: Income and Growth. The 10 portfolios of growth, with varying risk levels are aimed at long-term investors who don’t need income. You can view all the funds in each portfolio by registering with InvestEngine*. There is no obligation to make any investments.

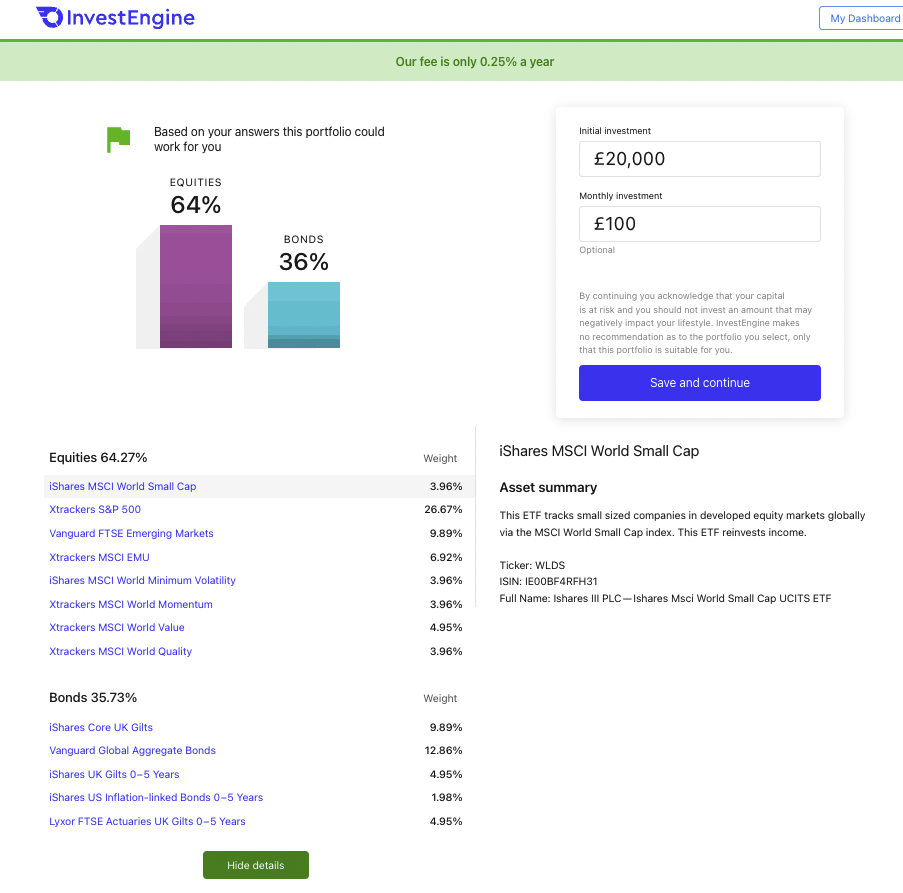

Registering to view the recommended portfolio takes just a few seconds. Below is the growth portfolio I was recommended to when I registered. Click the image to enlarge.

You can see the future growth projections for each portfolio as well as the asset mix. Although it is impossible to view data about a portfolio’s past performance on InvestEngine, this is likely due to the current regulation and the recency of its launch.

You can view each ETF’s past performance, however, because InvestEngine is transparent about which ETFs are in each portfolio.

InvestEngine’s income strategies are what make it stand out, while other robo-advice platforms like Nutmeg do not offer managed portfolios which generate regular income.

InvestEngine estimates that the income from its three income portfolios will be approximately 2.5%, 4.0%, and 5.0% per year. However, this number can change depending on market conditions. Hargreaves Lansdown, one of the more established DIY investment platforms, offers an off-the shelf managed income portfolio. (See alternatives section later).

Comparison

Hargreaves Lansdown charges 0.45% annually for platform management. This is nearly twice as high as InvestEngine’s equivalent fee of 0.25% per year. Both cases will require you to pay the annual fee of the fund or ETF that you invest in. This is standard across all platforms and robo-advice offerings.

Any income earned by InvestEngine can be automatically deposited into your bank account. You can view a monthly estimate of how much income you will receive in pounds and pence before you invest in any of the income portfolios. This is a wonderful feature as managing irregular dividend payments is one of the most difficult aspects of running an income portfolio.

Register with InvestEngine to see the asset mix, ETFs, and yield for each income portfolio. There are currently only three income portfolios that focus on bonds. The highest yielding portfolio has an 80% allocation to bonds, and only 20% to equities.

It is unfortunate that income portfolios with higher equity allocations are not included in order to take advantage the propensity of equities for a longer-lasting and growing income. This will hopefully change in the future.

InvestEngine offers a low management fee of 0.25%, which is applicable to any type of investment, including income and growth portfolios.

InvestEngine currently does not offer managed ESG portfolios. InvestEngine’s DIY portfolio service allows you to invest in ESG and ethical ETFs.

Free DIY portfolios

InvestEngine allows customers to create and manage their own portfolios using over 500 ETFs. This list includes ETFs such as HSBC, UBS, Vanguard, iShares and Xtrackers. However, it is the fact that there are no account fees, dealing charges, or setup fees that will attract most investors, both new and old. It is extremely affordable to create a DIY ETF portfolio using a limited selection of ETFs.

There is no upfront fee or platform fee. In this article, I will again compare the costs involved in building a DIY portfolio of ETFs on InvestEngine to other investment platforms.

Key features/features of InvestEngine

InvestEngine has many key features

ISA account, a General Investment Account (but not a Pension) -This account allows you to invest tax-free through a Stocks and Shares ISA and a general investment accounts, but there is currently no pension.

Business accounts

InvestEngine allows business owners and managers to invest cash within their businesses.

App

An app is available in the Apple App Store or Google Play Store.

10 Managed Growth Portfolios and 3 Income Portfolios – the former paying income directly into your bank accounts without any fees.

No platform fee and free DIY investing service You can manage your own ETF portfolio without any dealing fees, platform fees, or set-up fees. InvestEngine charges a 0.25% fee for managed portfolios.

Get access to over 500+ ETFs – including Vanguard and iShares ETFs.

One-click Portfolio Rebalancing – An innovative way to rebalance your portfolio to your predetermined ETF allocations in just one click.

Portfolio rebalancing automatically when you add/withdraw lump sums InvestEngine also implements your request to withdraw or add funds to your DIY portfolio while maintaining your investment allocation.

Customer service – Great customer support is another positive of the app. Although there is no phone number to contact, they got back to me within 24 hours when I asked a question about the investengine fees.

How to create an InvestEngine account

Signing up for InvestEngine is easy and quick. Although the design is minimalistic, it offers a simple and straightforward user experience. Signing up will ask you to select whether you wish to invest as an individual, or as a company. This fills a gap in the online wealth management market. Digital wealth managers offer accounts only for individuals.

You will then be asked if you would like to invest in a managed portfolio of InvestEngine or your own DIY portfolio.

You have the choice of opening an ISA account, or a general investment account (GIA). Unlike the GIA investment via an ISA will allow you to shelter any income or profits from capital gains tax and income tax, unlike the GIA.

InvestEngine accepts transfers from Stocks and Shares ISA accounts that are already in existence. So if you are thinking about consolidating your ISA, this is an option you could explore.

If you choose to create your own portfolio, you will be taken to a tool which allows you to choose your preferred ETFs from over 500 options and then to set the allocation percentage for each one.

Portfolio Assessment

Before you can receive a portfolio suggestion from InvestEngine’s 10 income and 3 growth portfolios, you will be asked a series of questions about your risk profile. Each portfolio includes a mix ETFs that are exposed to equities and bonds, as well as alternative assets such (such a gold) You can adjust the portfolio’s risk level by altering the asset mix, projected growth rates, and income yield.

The portfolio is not an official regulated investment recommendation. It is merely a suggestion that you can accept or change as you please. Nutmeg and Wealthify also offer regulated portfolio recommendations.

These recommendations are based on their investor questionnaires. The suitability of the portfolio is reviewed annually. InvestEngine places the responsibility on the customer to determine the suitability and associated risks of the portfolio.

What is the cost of InvestEngine?

InvestEngine’s cost is one of the best aspects. There are no exit fees. If you decide to move your money to another place later, you won’t be penalized. The ongoing investment fees will vary depending on whether you choose to invest in InvestEngine managed portfolios or go DIY and create your own portfolio.

Below are the details of each charge.

Managed portfolio costs

0.25% annum InvestEngine platform charges – which are lower than many of its rivals like Moneyfarm and Nutmeg (see below).

0.15 – 0.25% ETF Annual Charge According to InvesEngine, the average ETF fee is 0.16% for its growth portfolios and 0.25% for its income portfolios.

0.07% Market Spread InvestEngine calculates this at 0.07% per year on its ETFs. Market spread refers to the difference in price between an ETF’s buy and sell prices.

The total cost of an InvestEngine Growth Portfolio is approximately 0.47% per year. This table compares with the top digital investment managers (roboadvisers), in the UK.

DIY portfolio costs

InvestEngine doesn’t currently charge any platform or administration fees for its DIY portfolios. This applies whether you use the general investment account, Stocks and Shares ISA, or both.

Below is a comparison of the costs of creating and managing an ETF portfolio on InvestEngine versus market-leading DIY investment platforms.

When you invest via the Fund and Shares account, *Hargreaves Lansdown doesn’t charge 0.45% platform fees on ETFs. If you invest through an ISA, SIPP, or other type of account, the charge will be applied.

Vanguard funds can be purchased through InvestEngine, the most affordable way to do so.

Vanguard is growing in popularity with UK investors due to its low-cost ETFs. Unit trusts are also gaining popularity. Investors often want to be able access these funds at a low cost. Vanguard Investor is Vanguard’s own platform. However, Vanguard Investor is not the cheapest way for investors to purchase Vanguard ETFs.

Vanguard and InvestEngine

InvestEngine is the cheapest option to purchase Vanguard ETFs. It doesn’t charge any transaction fees, platform fee, or account opening fee. It does not offer all Vanguard ETFs and it doesn’t offer the Vanguard Lifestrategy fund range. They are unit trusts.

The Vanguard Investor platform is the most cost-effective way to access a larger selection of Vanguard ETFs or to invest in Vanguard Lifestrategy funds. Interactive Investor Review – Interactive Investor is the cheapest way to buy and hold Vanguard Lifestrategy ETFs or Vanguard Lifestrategy Funds, if you have invested at least £80,000 in Vanguard funds in your ISA, or £104,000 if using a SIPP. II (Interactive Investor), in addition to Vanguard funds and ETFs, provides access to thousands more investment trusts, ETFs, unit trusts, shares, and other units trusts.

iWeb does not charge an ongoing platform fee if Vanguard funds are invested. However, it charges £100 to open an account as shown in this table. This is quite expensive. I find the user experience to be far less pleasant. Hargreaves Lansdown does not charge a platform fee to invest in Vanguard ETFs if they’re purchased via its Fund and Shares Account. However, this would mean that your investments will be subject to tax.

If you wish to invest in unit trusts, such as the Vanguard Lifestrategy series, or use Hargreaves Lansdown’s SIPP or ISA for ETFs or funds, then an annual fee of 0.45% will be charged.

How does InvestEngine make it money?

Like other online wealth management platforms, InvestEngine makes its money from the 0.25% platform fee on its managed portfolios. InvestEngine doesn’t charge a platform fee for DIY portfolios. The founders have stated they may eventually develop its DIY portfolio service as a freemium model. Premium-paying customers will have access to more advanced features and options.

Is InvestEngine secure?

InvestEngine is authorised by and regulated under the Financial Conduct Authority. InvestEngine investments are covered by the Financial Services Compensation Scheme, (FSCS), up to a maximum of £85,000 in case InvestEngine goes bankrupt. NatWest Bank Plc holds client cash.

Alternatives to InvestEngine

Hargreaves Lansdown* are the market leaders for building a DIY portfolio of investment trusts, unit trusts and ETFs. Both Interactive Investor* or Hargreaves Lasdown* also offer their own readymade income portfolios*.

Both offer access to Junior ISAs, trading accounts, and pensions. Hargreaves Lansdown also allows you to invest through a Lifetime Isa. Hargreaves Lansdown also allows you to invest as low as £1, but the minimum you can invest in funds is £100 or £25 per month.

Wealthify* lets you invest as low as £1 to create a managed, ethical portfolio. We have other articles showcasing which stocks and shares ISAs are ethical and the Big Exchange is an option if ethical considerations are the key driver for your decision.

We have reviews of Moneyfarm and Nutmeg to help you choose a service that offers a portfolio recommendation based on a regulatory off-the shelf also.

Customer reviews for InvestEngine

InvesEngine currently has a 4.4 star rating out of 5.0 on Trustpilot based upon over 600 reviews. Many users have praised InvestEngine’s low-cost pricing structure and its simple website. Many reviews also praise InvetEngine’s customer service.

Pros and cons of InvestEngine

Pros

Welcome Bonus Offer (Terms & Conditions Apply)

Website and app are easy to use

No platform fees for DIY portfolios

Managed portfolios are less expensive than their competitors because they only pay a platform fee of 0.25% per year.

One-click portfolio rebalancing

Accounts for businesses

Access to over 500 ETFs

You can create a portfolio without having to invest by simply registering

Cons

Portfolios that are not ethically managed will not be accepted

There are no Lifetime ISAs, Junior ISAs or pensions available.

Flat fee structure: It does not decrease the amount you invest

There is no tool that can help you build a DIY income portfolio.

The £100 minimum investment is comparable to some of its robo adviser peers, but there are other minimums.

There is no direct share trading yet

Inability to invest, even though this is planned.

Is InvestEngine worth it?

InvestEngine* has been an innovative new entry into the DIY investing market. InvestEngine combines the best features of a variety of market incumbents (i.e. no platform fee for DIY portfolios, exit fees, managed portfolios), with innovative new features (such one-click rebalancing), to gain traction among new and experienced investors.

Its low cost approach will provide much-needed competition to established robo-advice platforms such as Nutmeg and established DIY investment platforms such as Hargreaves Lansdown.

Bottomline

Although it’s not perfect, there are no ethical portfolio options, no access to a retirement wrapper, and no direct share trading. However, these features are all being planned for the future and make it an interesting platform. It will appeal to all investors, regardless of whether you choose to invest or not. You can simply register and explore exchange traded funds, create your diy investment portfolio and all the other portfolio options. Based on our independent research, InvestEngine is one of the cheapest investment platform with no buying and selling fees.

- Tags:

- investing