Wealthify Review: A Comprehensive Analysis of the Investment Platform

Wealthify is a well-known robo-advisor in the UK that has been around for several years and is owned by Aviva. As a robo-advisor, Wealthify uses technology to help people invest their money without the need for a financial advisor. Their app and website make it easy to save and invest money, with a range of investment options available to suit individual circumstances.

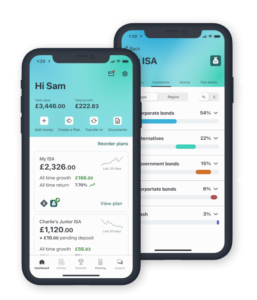

Wealthify’s experts handle everything after helping users decide on the best investment option for them. Users can open a Stocks & Shares ISA, a personal pension, a Junior ISA, or a standard account. The app is highly rated, with a 4.5-star rating on the Apple App store.

In this article, we will dive into the details of Wealthify and explore whether it is a suitable investment platform for beginners. We will cover how Wealthify works, the different account options available, fees, customer support, safety, pros and cons, customer reviews, and our thoughts on the platform.

Key Takeaways

- Wealthify is a robo-advisor owned by Aviva that uses technology to help people invest their money without the need for a financial advisor.

- Wealthify offers a range of investment options and account types, including a Stocks & Shares ISA, a personal pension, a Junior ISA, and a standard account.

- Wealthify has a highly rated app and website, making it easy for users to save and invest their money.

Is Wealthify good for beginners?

Wealthify is an excellent investment platform for beginners who have little or no experience with investing. The platform is designed to be straightforward and easy to use, and it requires minimal effort to get started. Wealthify’s investment experts handle all of the investments, so beginners don’t need any prior knowledge of investing to start.

One of the best features of Wealthify is that users can start investing with just £1, which is significantly lower than other investment platforms like Nutmeg and Moneyfarm, which require a minimum investment of at least £500.

Wealthify is also a great platform for those who want to learn more about investing. Even though the team of experts manage the investments, users can still learn where their money is being invested and what makes certain investments higher or lower risk.

Users can log in to their Wealthify account at any time to view their portfolio’s total assets, value and investment performance. Additionally, setting up a regular monthly payment is an affordable and excellent way to save money over time.

Overall, Wealthify is an excellent choice for beginners who want to start investing. The platform is easy to use, requires minimal investment, and provides users with the opportunity to learn more about investing while their investments are managed by experts.

How Wealthify Works

Wealthify is a robo-advisor platform that offers a range of investment accounts, including Stocks and Shares ISA, Junior ISA, personal pension, and a General Investment Account. It is a simple platform to use, and the user doesn’t have to worry about selecting and managing assets in a portfolio.

To get started, the user first needs to sign up to decide which type of account they want to use. The Stocks and Shares ISA is a popular choice for users who want to save their money. However, there is no Lifetime ISA available on Wealthify.

After selecting the account, the user needs to choose the investment strategy, which is called an investment style. The investment style ranges from low to high in risk level, and the user needs to select the one that suits their investment goals.

Investment Styles

Wealthify offers five investment styles:

- Cautious: This style is for those who don’t like too much risk. The goal is to not lose money while beating inflation.

- Tentative: This is the next lower-risk option, and the aim is to not make any losses while growing the money slowly.

- Confident: This is the medium option, and the goal is to achieve a good level of investment growth while still focusing on minimizing potential losses.

- Ambitious: This is a high-risk option, where the goal is to make the most amount of return on your money in order for greater compound growth over time. This can mean losses could be large and volatile changes in the balance.

- Adventurous: This is the highest risk option, and the goal is to achieve the highest investment growth possible. This can mean big changes in the balance, both up and down.

It’s worth noting that the Adventurous investment style is not suitable for users who want to take their money out of the account in the next couple of years. It’s for long-term investing, 5 years or more.

Investment Theme

After selecting the investment style, the user needs to choose where their money will be invested. Wealthify offers two investment themes:

- Original: This is Wealthify’s standard investment option, and it is a mix of investments from the UK and overseas.

- Ethical: With this option, Wealthify tries to avoid businesses that damage the environment and are socially responsible.

It’s essential to note that the ethical option is expected to make slightly less money over time.

In conclusion, Wealthify is a simple platform to use, and users can select the investment style and theme that suits their investment goals. By offering a range of investment accounts, Wealthify makes it easy for users to start investing and grow their money over time.

Your account options

General Investment Account

A General Investment Account is a standard account that does not come with any tax-free benefits. The good thing about these accounts is that you can have as many as you like, unlike a Stocks & Shares ISA where you can only pay into one per year up to a certain value.

If you want to learn more about these accounts, you can check out Wealthify’s guide on what is a General Investment Account.

Stocks & Shares ISA

Wealthify calls this an Investment ISA. With access to a Stocks & Shares ISA, you can invest up to £20,000 per year, and everything you make in the future is completely tax-free. It is important to note that the £20,000 is your total allowance across all of your ISA options, including a Cash ISA and a Lifetime ISA.

The Stocks & Shares ISA has no Capital Gains Tax, no Income Tax, and no Dividend tax, which are all types of taxes you could pay on investments, which is why its a favourite for savvy investors. However, you can only pay funds into one Stocks & Shares ISA per tax year (April 6th to April 5th the following tax year).

If you withdraw money and then re-add it, it counts as new money going into your ISA as part of your ISA allowance. Wealthify’s Investment ISA is not a flexible ISA. If you only want a flexible ISA, you can check out Moneyfarm¹.

Personal pension

A personal pension is a great option to save for your retirement in addition to savings in a workplace pension. All pensions are tax-free, just like savings in a Stocks & Shares ISA. However, you also get a bonus of 25% of everything you put in, which is automatically added by the government.

If you’re a higher rate or additional rate taxpayer, you can claim back some of the money you’ve paid at those rates too, it’s worth speaking to an accountant (40% and 45%). You would do this on your Self-Assessment tax return. However, there are some limits. Note, that you can only afford to pay the total of your income each year or £60,000, whichever is lower, and this lump sum is across all of your pensions.

You won’t be able to touch the pension money until you’re 55 (57 from 2028). It is for retirement after all. You may also pay Income Tax when you retire, depending on how much you withdraw from your pension annually, just like if you were earning a salary. You can learn more about personal pensions and view our review of all the best personal pension providers.

Junior ISA

A Junior ISA is a great option for parents who want to save for their children’s future. You can set up an account in your child’s name, and they’ll get access to it when they’re 18. Everything they make in the account is completely tax-free, and you can invest up to £9,000 per year. This is in addition to your own ISA allowance of £20,000. If you want to learn more about Junior ISAs, you can check out Wealthify’s guide to Junior ISAs.

Wealthify fees

Wealthify charges an annual management fee of 0.6% per year, which is a simple and easy-to-understand fee. This fee is a direct payment to Wealthify and is calculated as a percentage of the total amount in the account.

In addition to the management fee, investors also pay a fee for the investments themselves. The cost of this fee varies depending on the investment and ethical options option chosen. For the original investment option, the average cost is 0.16% of the total investment per year. However, for the ethical theme, the average cost is much higher at 0.70% per year.

As a result, the total fee for the original investment option is approximately 0.76% per year, while the total fee for the ethical investment option is approximately 1.30% per year. These fees are in line with other Robo-investment service providers.

Original theme fee comparison

When comparing Wealthify’s fees with other investment platforms, it’s clear that Wealthify is the cheapest option. The table below shows a comparison of Wealthify’s fees with Moneyfarm and Nutmeg:

Investment platform Management fee Investment fees Total fee Wealthify 0.60% 0.16% 0.76% (Cheapest) Moneyfarm 0.75% 0.29% 1.04% Nutmeg 0.75% 0.27% 1.02%

Ethical theme fee comparison

When it comes to ethical investing, Wealthify is more expensive than other investment platforms. The table below shows a comparison of Wealthify’s fees with Moneyfarm and Nutmeg for ethical investing:

Investment platform Management fee Investment fees Total fee Wealthify 0.60% 0.70% 1.30% Moneyfarm 0.75% 0.30% 1.05% (Cheapest) Nutmeg 0.75% 0.35% 1.10%

Overall cost comparison

One significant difference between Wealthify and other investment platforms is how the management fee changes based on the amount of money invested. With Wealthify, the management fee remains the same regardless of the amount invested (0.60%). On the other hand, with Moneyfarm and Nutmeg, the management fee decreases as the amount invested increases.

For example, with Moneyfarm, the management fee starts at 0.75% and decreases to 0.35% for portfolios above £500,000. Similarly, with Nutmeg, the management fee is 0.75% for portfolios up to £100,000 and then decreases to 0.35% for portfolios above that amount.

Therefore, for larger portfolios, Moneyfarm and Nutmeg may be a cheaper option. However, it’s essential to consider other factors, such as customer service, previous investment performance, and user-friendliness of the platform, before making any investment decisions.

For those starting with a low portfolio or just beginning to save, Wealthify is the cheapest option, especially after paying for the original investment theme. It’s also worth noting that the minimum investment for Nutmeg and Moneyfarm is £500, making Wealthify a more affordable and accessible option for those with lower investment amounts.

In conclusion, Wealthify offers competitive fees for both the original and ethical investment themes, making it an attractive option for novice UK investors. However, for larger portfolios and ethical funds, other investment platforms such as Moneyfarm and Nutmeg may be more cost-effective.

Customer Support

Wealthify provides excellent customer support to its users. Customers can reach out to them via phone or live chat, which is available from Monday to Friday between 8am to 6:30pm and on Saturdays from 9am to 12:30pm. The live chat feature is available on both the app and website. Alternatively, customers can send a message and get a response via email. The FAQ section on their website is also a great resource for customers to find answers to their queries. The availability of a phone line and live chat feature sets Wealthify apart from other investment platforms and modern businesses in general.

Is Wealthify Safe?

Wealthify is a safe investment platform that is authorised and regulated by the Financial Conduct Authority (FCA), which means that they have been approved to handle and manage your money. Additionally, Wealthify is owned by Aviva, a large financial services company, which provides further reassurance.

Investors are also protected by the Financial Services Compensation Scheme (FSCS), which ensures that if Wealthify were to go out of business, investors would be eligible to receive up to £85,000 in compensation.

Overall, Wealthify is a safe investment platform that is well-regulated, backed by a reputable company, and provides investors with the necessary protection.

Pros and Cons

Pros

- Simple and user-friendly platform

- Low initial investment of just £1 (£50 for pensions)

- Excellent customer service

- Reasonable fees for original investment option

Cons

- High cost for ethical investment option

- Not a flexible ISA

- No Lifetime ISA

Wealthify Customer Reviews

Wealthify has a great reputation among its customers, with a Trustpilot score of 4 out of 5 from over 2,100 reviews. Customers appreciate the ease of use and getting started, as well as the quality of the app and customer service. Wealthify’s high customer satisfaction is especially impressive for companies not in financial services, where good customer service is often overlooked.

Our Thoughts

Wealthify is a great option for those who want to kick start their investing but don’t know where to begin. With their expert team handling everything, investors don’t need to have any prior knowledge of investing. Wealthify’s own customer service team is also noteworthy, with the option to speak to someone on the phone or via live chat.

The fees are reasonable and easy to understand, but their ethical investment option has slightly higher fees compared to other robo-advisors like Moneyfarm. This is a downside for those who prioritize ethical investing, which is why Wealthify has been given a rating of 4 stars instead of 5.

Overall, Wealthify is a solid choice for those who want to invest without the hassle of managing their own portfolio. If you’re interested in learning more about Wealthify or want to get started, head over to their website. However, it’s important to remember that investing always carries a risk and your capital is at stake.

Other Investment Apps

Check out our blog on best investment apps to learn more about other options.

Frequently Asked Questions

What are the fees for Wealthify and how do they compare to other investment platforms?

Wealthify charges an annual management fee ranging from 0.5% to 0.7% depending on the investment plan. This fee is lower than some traditional investment platforms like Hargreaves Lansdown but higher than robo-advisors like Nutmeg. Wealthify also charges a fund cost ranging from 0.22% to 0.24% which is lower than the industry average.

What are the main differences between Wealthify and Nutmeg?

Wealthify and Nutmeg are both robo-advisors that offer investment portfolio management services. Nutmeg offers a wider range of investment options and has a more complex pricing structure than Wealthify. Wealthify, on the other hand, offers a more user-friendly platform with a simpler pricing structure and a lower minimum investment amount.

Is Wealthify a legitimate investment platform and how secure is my money?

Wealthify is a legitimate investment platform regulated by the Financial Conduct Authority (FCA) and is covered by the Financial Services Compensation Scheme (FSCS). The FSCS covers investments up to £85,000 per person per firm in case of insolvency or fraud.

Can I invest just £50 with Wealthify and what are my investment options?

Yes, you can invest just £50 with a Wealthify account. Wealthify offers five investment plans ranging from cautious to adventurous. The investment plans are designed to suit different risk appetites and investment goals.

What are the benefits of using Wealthify over other investment platforms like Hargreaves Lansdown or Vanguard?

Wealthify offers a user-friendly platform with a simple pricing structure and a low minimum investment amount. Wealthify also offers a range of investment plans designed to suit different risk appetites and investment goals. Compared to traditional investment platforms like Hargreaves Lansdown or Vanguard, Wealthify has lower fees and offers a more accessible investment platform.

Are the fees for Wealthify considered high compared to other investment platforms?

Wealthify’s fees are lower than some traditional investment platforms like Hargreaves Lansdown but higher than some other robo-advisors like Nutmeg. Wealthify’s fees are considered reasonable for the level of service and investment options offered.

Do you mind if I quote a few of your posts as long as I provide credit and sources

back to your website? My website is in the exact same area of interest as yours and my users would genuinely

benefit from some of the information you provide here. Please let me know if this alright with you.

Regards!

Sure. No problem.