Penfold Pension: A Comprehensive Guide to Retirement Planning

When we first looked at Penfold Pension, they were a pension provider built for the self-employed. A lot has changed since then. They have restructured their business to accommodate the employed and self-employed.

Penfold is a digital pension company that offers a simple and user-friendly way for individuals to save for their retirement. Founded in 2018, the company aims to make pensions accessible and easy to understand for everyone, regardless of their financial knowledge or experience.

One of the key features is its auto-enrolment service, which makes it easy for employers to set up and manage workplace pensions for their employees. The company offers a range of pension plans, including a standard plan and a sustainable plan, which allows individuals to tailor their pension to their investment preferences and stage of life.

For the self-employed, including but not limited to freelancers, and limited company directors, they also have a done-for-you type service where you can manage your pension in a super flexible and really easy-to-use platform.

Key Takeaways

- Penfold Pension is a digital pension company that offers a simple and user-friendly way for individuals to save for their retirement.

- The company offers a range of pension plans, including a standard plan and a sustainable plan, which allows individuals to tailor their pension to their investment preferences and stage of life.

- Penfold Pension has received positive reviews from customers, who appreciate the company’s transparency, customer service, and easy-to-use platform.

History of Penfold Pension

Penfold Pension is a UK-based digital pension provider that was established in 2018. The company was founded by Pete Hykin and Chris Eastwood, who identified a need for a flexible and straightforward pension scheme for the self-employed.

In 2019, Penfold launched its pension scheme, which was specifically designed to encourage self-employed individuals to save for their retirement. At the time of launch, up to 80% of self-employed people in the UK were not saving into a pension. Penfold aimed to solve this problem by offering a simple and accessible pension scheme that would encourage more people to save for their future.

In early 2021, Penfold expanded its pension scheme to all individual savers, not just the self-employed. This move allowed Penfold to offer its pension scheme to a wider audience and provide more people with a flexible and straightforward way to save for their retirement.

Since its launch, Penfold has received positive reviews for its user-friendly platform and customer service. The company hard work has also been recognised by various industry awards, including the 2021 Investment Week Digital Impact Awards, where it won the Best Digital Direct-to-Consumer Offering award.

Overall, Penfold Pension has quickly established itself as a leading digital pension provider in the UK, offering pensions industry a simple and accessible way for individuals to save for their retirement.

Features of Penfold Pension

Penfold Pension offers a range of features to help individuals save for their retirement. Here are some of the key features of the Penfold Pension:

Investment Options

With the Penfold Pension, users have the freedom to choose their own investments or select one of the pre-set Standard plans. Each Standard investment plan aims to achieve a certain level of returns over a five-year period while controlling volatility within a defined range. The Standard plans range from Level 2 with a volatility range of 6-9% to Level 4 with a 10-15% volatility range. Users can also choose from a range of investment options, including ethical and sustainable funds, to align their investments with their values.

Flexible Contributions

Penfold Pension offers flexibility when it comes to contributions. Users can choose to pay money in or transfer benefits from other suitable pension arrangements. There are no minimum contribution amounts, and users can increase, decrease, or pause their contributions at any time. This flexibility allows users to adjust their contributions based on their financial situation.

Tax Benefits

Contributions made to the Penfold Pension are eligible for tax relief. This means that for every £1 paid into the pension, the government will add an extra 25p, up to certain limits. Additionally, any growth in the pension is free from UK income tax and capital gains tax. This tax-efficient structure allows users to maximise their retirement savings.

In summary, the Penfold Pension offers a flexible and tax-efficient way for individuals to save for their retirement. With a range of investment options and the ability to adjust contributions, users can tailor their pension to their individual needs.

How to Set Up a Penfold Pension

Setting up a Penfold Pension is a quick and easy process that can be completed completely free and online in just a few minutes. Here are the steps to follow:

- Visit the Penfold Pension website and click on the “Get Started” button.

- Fill in your personal details, including your name, address, and national insurance number.

- Choose the type of pension plan that best suits your needs. You can choose from a range of options, including a self-invested personal pension (SIPP) or a workplace pension.

- Decide how much you want to contribute to your pension each month. You can choose to make regular contributions or make one-off payments as and when you can afford to.

- Provide your bank details so that Penfold can set up a direct debit to collect your pension contributions.

- Verify your identity by providing a document such as your passport or driver’s licence.

- Review and confirm your details, then submit your application.

Once your application has been processed, you will receive a welcome pack containing all the information you need to manage your Penfold Pension account.

Penfold Pension offers a range of benefits, including low fees, flexible contributions, and the ability to manage your pension online. With Penfold, you can be confident that your pension is in safe hands, and that you are on track to achieve your retirement goals.

Managing Your Penfold Pension

When it comes to managing your Penfold pension, there are a few things to keep in mind. Here are some of the key aspects to consider:

Online Access

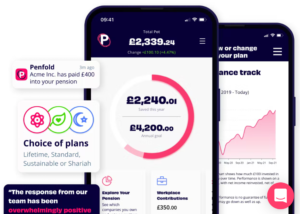

One of the main benefits of using Penfold is the ease of online access to your pension account. Once you have set up a password for your account, you can log in to view your balance, contributions, and investment performance. You can also make changes to your investment strategy and adjust your risk level as needed.

Penfold’s online platform is user-friendly and straightforward, making it easy for anyone to manage their pension account. You can access your account from any device with an internet connection, whether it’s a computer, tablet, or smartphone.

Customer Support

If you have any questions or concerns about your Penfold pension, the company’s customer support team is available to help. You can reach out to them via email or phone, and they will be happy to assist you.

Penfold’s customer support team is known for being responsive and knowledgeable, so you can feel confident that you will get the help you need. Whether you have a question about your account balance or need help making changes to your investment strategy or business move, the Penfold team is there to support you.

Overall, managing your Penfold pension is a straightforward and user-friendly process. With easy online access and excellent customer support, you can feel confident that your pension is in good hands.

Penfold Pension Reviews

Penfold Pension has received generally positive reviews from its customers. On Trustpilot, the platform has a rating of 4.5 out of 5 stars based on over 400 reviews. Customers have praised Penfold for its user-friendly app, easy-to-use interface, and helpful customer service. One customer commented, “I found Penfold easy to use and access, I like being able to access my pension account using the app. The app is simple and easy to navigate. Communication with Penfold is effective.” Another customer wrote, “Great customer service, prompt response and very helpful team. The app is easy to use and I can track my pension contributions easily.”

Similarly, on Good Money Guide, Penfold Pension has a rating of 4.78 out of 5 based on 336 reviews. The review highlights Penfold’s low fees, flexible contributions, and easy-to-use app. The reviewer notes that “Penfold’s fees are very competitive, and they offer a flexible range of contributions. The app is easy to use and navigate, and overall, Penfold is an excellent choice for those looking for a low-cost pension plan.”

On Investing Reviews, Penfold Pension has received positive reviews for its low fees, flexibility, and transparency. The review notes that “Penfold offers a low-cost pension plan that is flexible and transparent. The app is easy to use, and customers can easily track their contributions and investment performance. Overall, Penfold is a great choice for those looking for a low-cost, flexible pension plan.”

In summary, Penfold Pension has received positive reviews from its customers for its low fees, flexibility, user-friendly app, and helpful customer service.

Closing Your Penfold Pension

Closing your Penfold pension is a straightforward process. If you decide to close your account, you can do so by logging into your account and following the steps outlined in the platform.

Once your account is closed, your pension pot will be transferred to your chosen provider. If the value of your pot has gone down since you transferred it to Penfold, the amount returned to the provider may be less than what you originally transferred. Learn more about the average pension pot you should aspire to on our blog.

It’s important to note that if your former partner or employer is currently paying into your pension, transferring that pot may mean you lose out on their contribution. Therefore, it’s advisable to seek professional advice before making any decisions about closing your pension account.

If you have any questions or concerns about closing your accounts with Penfold pension, you can contact their customer support team via email or phone. They will be happy to assist you with the process and answer any questions you may have.

Penfold understands that circumstances change, and they strive to make the process of closing your pension account as easy and hassle-free as possible. They aim to provide their customers with the flexibility and control they need to manage their pensions with confidence and peace of mind all the hard work behind.

Frequently Asked Questions

What is the performance of Penfold Pension?

As a relatively new player in the UK pension market, having been set up in May 2019. As such, there is limited data available on its performance. However, Penfold states that its investment strategy is designed to provide long-term growth and offers a range of investment options to suit different risk appetites.

What type of pension does Penfold offer?

Penfold offers a Self-Invested Personal Pension (SIPP), which allows users to choose from a range of investment options and manage their pension online or with its app. The platform offers a choice of investment portfolios, including ethical and socially responsible options, as well as the ability to invest in individual stocks and shares.

Can I withdraw my pension from Penfold?

Yes, you can withdraw your pension once you reach the age of 55. However, you should be aware that withdrawing your pension early may result in tax penalties and a reduced retirement income.

Is Penfold Pension a good option for retirement?

The suitability of investing in Penfold Pension as an option for retirement will depend on your individual circumstances and financial goals. However, Penfold offers a range of investment options and provides a user-friendly platform for managing your pension, which may be attractive to some users.

What are the tax relief options for Penfold Pension?

As with other pension schemes, they offer tax relief on contributions. This means that for every £1 you contribute, the government will add an extra 25p if you are a basic rate taxpayer, or 50p if you are a higher or additional rate taxpayer. However, there are limits on the amount you can contribute each year and still receive tax relief.

What are the other Pension provider options?

Check out our reviews on Pension Bee and St.James Place Pension.